Bank Marketing Strategy

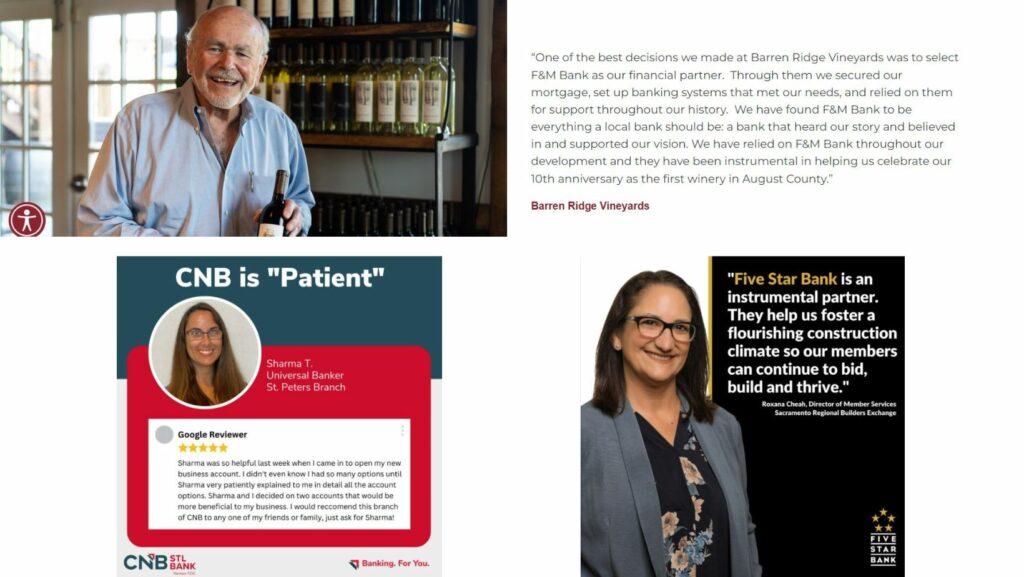

Testimonials have long been a key content strategy for many successful marketing campaigns. But with the prevalence of social media and review sites like Google Business Review and Yelp, there is not only more emphasis given to the opinion of others during a customer’s decision-making cycle, but their peers’ feedback is also more accessible than ever.

In addition, testimonials can help build a stronger relationship with your existing customers, while providing insight to potential customers into how your products or services can be a benefit to their financial wellbeing. In this post we will discuss the importance of using your customers’ voices as leverage in your marketing strategy, from how to ask for usable feedback from your bank customers to how to best use customer stories and client testimonials to create the biggest impact for your marketing dollar. But first, let’s start with the basics.

What is a testimonial?

In marketing, a testimonial is a statement made by customers that discusses their experience with your product or service—hopefully mentioning benefits and including a recommendation. Testimonials can be included as quotes on your website or reviews on platforms like Google or Facebook.

When promoting positive testimonials through your online presence, you can acquire them from a number of places. You can ask for these statements directly, through surveys or direct requests or from individuals you have worked with. You can also pull testimonials from other sources, including online reviews and social media comments.

Why are testimonials critical in bank marketing?

When you use bank client testimonials as part of your marketing strategy, you can achieve four important results.

- Build trust. Showing the value or the quality of your own products and services is certainly necessary, but when your claims are backed by your customers, it shows that they are grounded in truth. When potential customers see positive testimonials about any one component of your financial services, they can see your institution as more trustworthy, and extend that trust to other areas of service you offer as well.

- Avoid the obvious sales pitch. In the same way that testimonials can build trust, they can also help your financial institution effectively exhibit its merits without the ‘hard sell’—a turn off for most modern customers.

- Put customers in the drivers’ seat. Instead of feeling like they are being coerced into opening an account, purchasing a policy, or applying for a loan, customers can use your testimonials as part of their own research and decision-making process. This can not only make them more confident in their choice, but also more likely to remain loyal to your bank, credit union, or company.

- Optimize your site for search engines. Testimonials don’t just help customers see the value in what you have to offer, but online reviews can also help potential customers discover your financial institution to begin with, navigating them to your site to learn more. Additionally, positive reviews on popular third-party sites have the potential to increase your website’s domain authority, promoting its ranking in search engines. And lastly, for testimonials you gather to include on your own site, you can choose excerpts that incorporate specific key words and phrases to help boost your site’s search engine performance.

Key Considerations When Incorporating Customer Testimonials

Beyond the user experience you give your customers, you may have little control over reviews your customers post on online platforms, and we all know that feedback in the banking sector won’t always be positive because of unique financial challenges individual customers may face. However, the way you choose to incorporate customer reviews and recommendations on your own website can be equally important and effective—as long as you follow certain principles.

Be authentic.

Don’t edit your customers’ testimonial beyond spelling or grammatical fixes. Instead, use their own words as much as possible. Rehearsed, pre-written, and polished soundbites may sound good, but can come across as inauthentic or dishonest. People are more likely to believe—and consequently value—conversational verbiage and casual language.

It’s also important to note that reviews and testimonials do not need to be perfect in order to convince a potential customer that your institution is the right choice. An overly glowing testimonial may come across as suspicious or insincere, whereas an honest review complete with detail (and event a frank mention of minor potential drawbacks) can ultimately be more persuasive.

Be specific.

Many customer-provided statements like “I love this bank” or “this credit union is great for my business needs” can be generic and unconvincing. As The Financial Brand points out, “it’s not enough to sit back and wait for testimonials and endorsements to come in. Instead, get proactive by soliciting reviews.” When you request reviews, you can use guided questions to pull out specific details that can be more convincing or helpful than a self-initiated review.

Here are a few examples of questions you can ask to induce those all-important specific details:

What specific products do you utilize at the bank and how do you anticipate they will impact your business?

What benefits do you get from the online banking app?

What are some ways that our representatives serve your banking needs?

What services do we provide that offer the most value to your family?

Who has provided the best banking experience for you and why?

Why have you chosen our bank or credit union to serve you for X number of years?

Is there a specific instance you can remember when a representative helped you or business?

Individually, personal stories can be relatable to customers seeking the same qualities or services discussed; in total, they speak to the power and trustworthiness of your bank’s services as a whole.

Show potential customers what they are missing.

Those same specific details and personal stories can be effective at showing potential customers what their experience could be if they chose to work with your financial institution, taking advantage of the very real effect of FOMO—fear of missing out.

When individuals have poor experiences with other banks—especially those faceless national ones—seeing evidence of the positive personal connections they could be making at your smaller, local, and customer-focused bank or credit union can be the motivating force they need to switch teams. Center your campaign around this strategy, reminding prospects what they are missing by not banking with your institution, and adding testimonials that exhibit these beneficial experiences to web pages and in marketing communications.

Don’t forget video.

Many forms of testimonial, from reviews to quoted endorsements, involve the written word. But it’s important to not undervalue video as a useful and effective tool. Videos can put a human face to the account, radiating enthusiasm, passion, energy, and honesty. Though most individuals are not professionals on camera, that can work to your advantage, creating a sense of authenticity that even practiced actors will never be able to attain.

Don’t have a film studio at your disposal? Capturing video can be as simple as using your smartphone camera if you don’t have the resources to work with a professional film crew and producer. The key is to help make your speaker feel comfortable. Don’t coach them on how to praise your bank—instead, provide encouragement or gentle guidance as needed.

Harness testimonials for your marketing strategy.

Even if you are not using testimonials in your current marketing campaign, it’s still critical to have third-party validation of your bank and services in a world where testimonials have immense impact on a business. In fact, today’s customers rely heavily on online reviews: 93% of consumers say online reviews have impacted their decisions, while 81% use Google when considering whether to patronize local businesses.

Are you ready to start taking advantage of the extensive marketing potential of testimonials? Schedule a no-pressure call with a BankBound strategist today to learn more about our proven content management, SEO (Search Engine Optimization), and other digital marketing strategies—and how we can help you harness the power of bank customer testimonials.