In order to convince your executive team to give you the green light on a digital strategy, it’s important to speak their language. Avoid making your appeal about you, him, or her. Instead, avoid all the egos by directing your executive team’s attention to actual data. Here are a few digital marketing stats to help you get the conversation started:

- [importance of content marketing] Content marketing generates 3 times as many leads as traditional outbound marketing, but costs 62% less. (ragan)

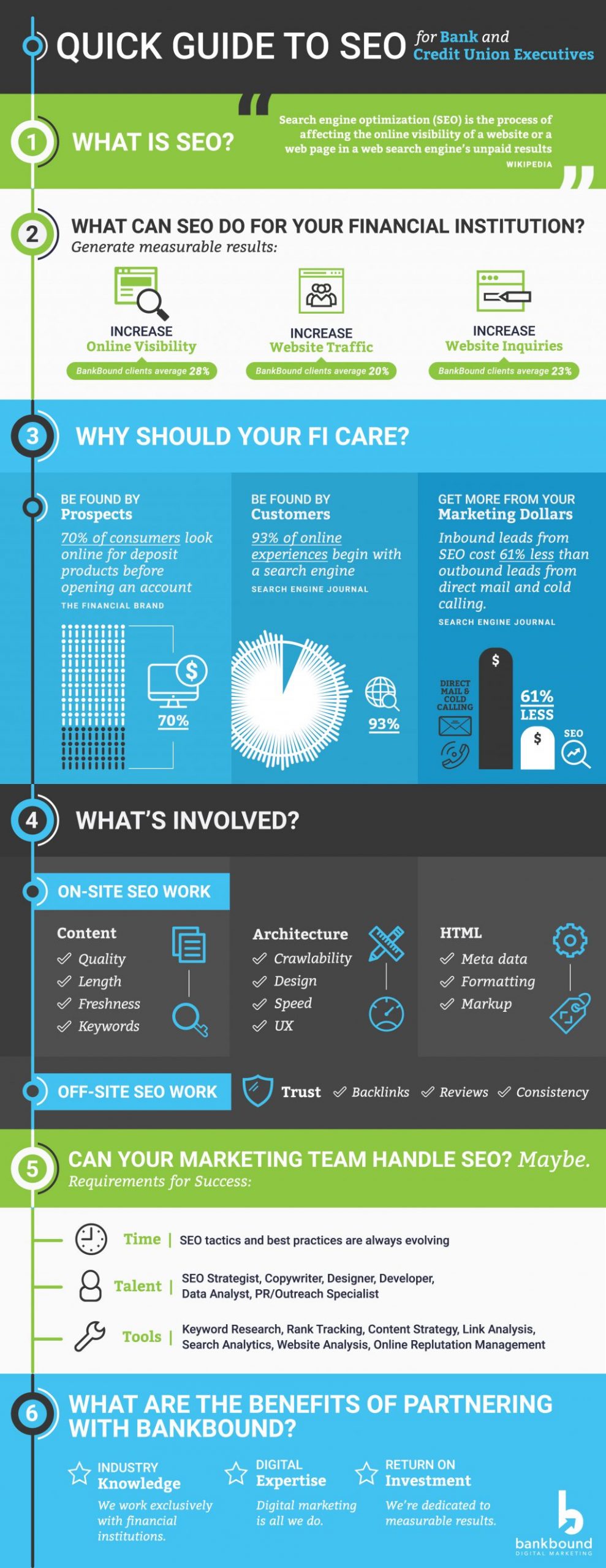

- [importance of SEO] SEO leads have a 14.6% close rate, while outbound leads (such as direct mail or print advertising) have a 1.7% close rate. (Search Engine Journal)

- [importance of search marketing] 70% of consumers look online for deposit products before opening an account. (The Financial Brand)

- [importance of mobile marketing] Nearly 60% of all internet traffic in the US is from mobile devices (statista)

- [pure peer pressure] 80% of companies plan to increase their digital marketing budgets (AdvertisingAge)

As you can see, the data is certainly on your side! After all, nearly every aspect of digital marketing is measurable, unlike many traditional marketing channels that your executive team may already be comfortable investing in.

Take a Phased Approach

Now that you have the executive team’s attention, you can build up their confidence in digital by slowly introducing digital tactics into your existing marketing strategy. Is your bank currently running billboards, radio, or television advertising? These campaigns come with considerable expense, a short shelf-life, and frustratingly vague value. Digital marketing can help measure the impact of these traditional campaigns and also improve their effectiveness through use of landing pages, tracking numbers, tracking URLs, personalized URLs (PURLs) and remarketing ads.

After you’ve successfully implemented digital tactics to improve your traditional marketing campaigns, you can more effectively measure the true impact of these efforts. Now is the perfect time to let the data do the talking; ask your executive team for approval to test the ROI of your current marketing campaigns against a purely digital campaign. Any digital marketer worth their salt would be delighted to face-off their pay per click ad campaigns against a billboard or radio spot. Simply allocate the same amount of ad spend towards your digital PPC campaign that you’re investing in billboards and see which campaign has better ROI after the chosen test period. Once your executive team can see real results from digital they should (hopefully) be a lot more receptive!

Align Digital Strategy to Strategic Goals

How many Facebook likes does it take to close a commercial real estate loan? The better question is- who cares?

Instead of trying to rally the marketing committee or executive team around vanity metrics, use real KPIs for your digital efforts to substantiate the investment. By defining leading and lagging indicators you can more effectively translate digital marketing jargon into a business case for your strategy. Even if you’re not sure of what your target numbers should be, at least you can benchmark your growth over time using the established success criteria.

How Not to Pitch Digital Marketing to Bank Executives

When earning buy-in for a digital marketing strategy, it’s important to try and put yourself in the shoes of bank executives. Just like any other marketing campaign, it’s worth mapping out what’s most important to decision makers and what barriers might exist. Executives want to maximize profits and minimize risk; they’re much less excited about the latest marketing trend or tactic. Keeping this perspective in mind, here are a few approaches to avoid with your digital marketing pitch: