Bank Marketing Strategy

Many economists define a recession as two straight quarters of negative Gross Domestic Product (GDP) growth. According to the Bureau of Economic Analysis, the first two quarters of 2022 had negative GDP growth, suggesting that the United States may have had or may currently be in a recession. As of this post, as inflation rates are at 8.2%, stock markets have been trending down, and the Federal Reserve is continuously raising interest rates, you might believe we are heading toward a deeper recession. Although Q3 2022 had positive growth, the factors above suggest that the economy will continue to slow down.

Cutting expenditures during a recession is necessary for many companies; however, marketing is not the place to cut. In both the 1981-82 recession and 1974-75, companies that continued to invest in advertising realized a significant return. The approximate growth seen during the 1981-82 recession for companies that maintained their marketing budget was 256%. During the 2008 recession, when many companies were slashing their marketing budget, those that held their budgets in place saw up to 350% more brand visibility than those that didn’t. History shows that you should not cut your bank’s marketing budget; instead, use it wisely. We have created a list of ways to pivot your bank’s marketing during a recession:

1. Only pay for marketing that you can track

When talking to the CEO or CFO of your bank to justify your marketing budget, you’ll need to prove what you are doing is working. Vanity marketing pieces such as magazines, billboards, and newspaper ads all have one thing in common; you can’t track to see if your actions are working. These marketing channels are great to bolster your brand if you have the extra budget. However, when your marketing budget is tight or about to be cut, these items should be the first.

2. Implement tracking on your website

Wouldn’t it be nice to know what people did on your website? Google Analytics gives you the ability to see traffic on particular pages as well as any conversions. What is a conversion? A conversion could be an online account opening, downloading a mortgage application, clicking to contact your business, or getting directions through your maps. You can set up goals in Google Analytics for your trackable conversion events. By doing this, you will know how people found your website, what pages people visit, and how long they stay on it.

When utilizing social media ads, you will want to add a tracking pixel for the social media platform. Meta, LinkedIn, and Twitter all utilize tracking pixels. By adding a tracking pixel for your website and define each conversion so you can effectively attribute your conversions from the social media platforms.

3. Continuously work on optimizing your conversions

While we are on the topic of websites, we should mention Conversion rate optimization. Conversion rate optimization is an ongoing process where you measure what happens once visitors are on your website, then make changes to try and increase conversions. You can monitor the effectiveness of each change by implementing A/B tests with Google Optimize. Additionally, you can also utilize heat maps on your website to see where people are looking on your website. The goal is to help your potential customers to convert more quickly and easily.

4. Move your marketing strategy to trackable marketing efforts

There are several ways to track your marketing, but digital marketing has an inherent advantage for trackable marketing. The top digital strategies that allow you track are social media marketing, email marketing, Pay-Per-Click marketing, and Search Engine Optimization.

Social Media Marketing

In 2022, there were over 100 million United States Citizens on at least one social media platform according to a study done by Statista. With so many people on social media websites, it makes sense to use social media as a platform for advertising. Social media marketing also has the benefit of being able to track the effectiveness of your advertisements. Each social media platform typically has its own analytics. Additionally, Google Analytics will capture how the new user was referred to your website.

Email marketing is one of the most cost-effective marketing channels available. A recent email marketing report showed that every $1 spent on email marketing could bring up to a $36 return on investment. A simple way to start email marketing is by cross-selling to current bank customers. If you know that a customer has a checking account with you but doesn’t have any other accounts, send them an email about great rates for CDs, loans, or even a savings account. It is easier to grow your current clients than to work to obtain new customers. Another thing you can do to grow your marketing email list is to use your website to capture leads. By putting a form on your website and having the person opt into receiving emails, you can now send promotions to them.

Pay Per Click (PPC) Advertising

Marketing is all about the right message to the right people at the right time. Search ads allow you to get in front of the right people when they are seeking a service your bank or credit union offers. With PPC advertising, you only pay when someone clicks on your ads. On average, Google Search Ads have a conversion rate of around 5% while the average cost per click is about $4, making it a very cost-effective way to market to people searching for products that you sell.

Content Marketing and Search Engine Optimization (SEO)

Optimizing your website to be found by search engines is a seemingly free way for customers to find you. If you can rank on the first page of Google for relevant searches, your traffic volume will go up substantially. There are a few ways to do SEO: one is to work on the technical SEO, where you help Google understand your website a little better. Another way is trying to rank for keywords. You can achieve a higher ranking by writing content relevant to your business and items your target audience cares about. SEO is a long-term plan, so you won’t typically see instant results, but it is great for a continuous effort.

5. Fine-tune your messages to your target audience

You will always want to get a message to potential customers that resonates and targets their pain points. During this time of inflation and recession headwinds, people face many financial pressures. They may be concerned that their dollar isn’t going as far as it used to, or they are afraid of job loss and might want to start saving. As marketers, it’s our job to find a message that works for our audience and not seem tone-deaf to what’s happening around us. Banks and Credit Unions can target their content strategies to account for times of slow incomes for clients and offer things like “skip-a-payment” loan options or low-interest credit cards. By crafting a message centered around your audience’s pain points, you are more likely to have a successful marketing campaign.

6. Take advantage of targeting through advertising platforms

Most advertising platforms’ targeting abilities are very robust, so utilizing this to your advantage can help you save your marketing dollars. With most digital marketing platforms, you can target one or more of the following criteria: geographic, demographic, interest, psychographics, as well as others. As a financial institution, you may not be able utilize all of those targeting methods, but you can use interests and geographical locations. Targeting by interests allows you to find those interested in a product you offer or items that would require your assistance as a financial institution, such as buying a home or vehicle.

7. Take advantage of Remarketing Ads

Remarketing has been known to increase the likelihood of someone converting by up to 70% over someone who hasn’t been remarketed. Depending on how you set up your remarketing ad, the people in these groups self-select what products they want to be advertised. This helps you because they are already familiar with your brand and, most likely, your advertising product. The goal of remarketing is that your ad reaches them when they are ready to convert. As a compliance note, all the same targeting rules apply for remarketing as regular targeting.

8. Utilize Negative Keywords

When you are doing search ads, you will be able to see what people searched for when your ads appeared (called Search Terms Report in Google). To help control your spending, look at the result and weed out any searches that might be for a specific bank, be irrelevant, or might be better suited for a different campaign.

9. Manage Your Keywords

If your budget is small, you want to ensure you are bidding on relevant and cost-effective keywords. You can utilize 3rd party websites to see how competitive a keyword is and approximately how much you might be spending to appear for that search term. If a keyword seems out of the budget or highly competitive, you can utilize long-tail keywords to help you. Such as, instead of “Home Mortgage,” you could do “best home mortgage in Utah.” Adding a state to the phrase also helps you localize your searches. Smaller local financial institutions may want to localize some keywords.

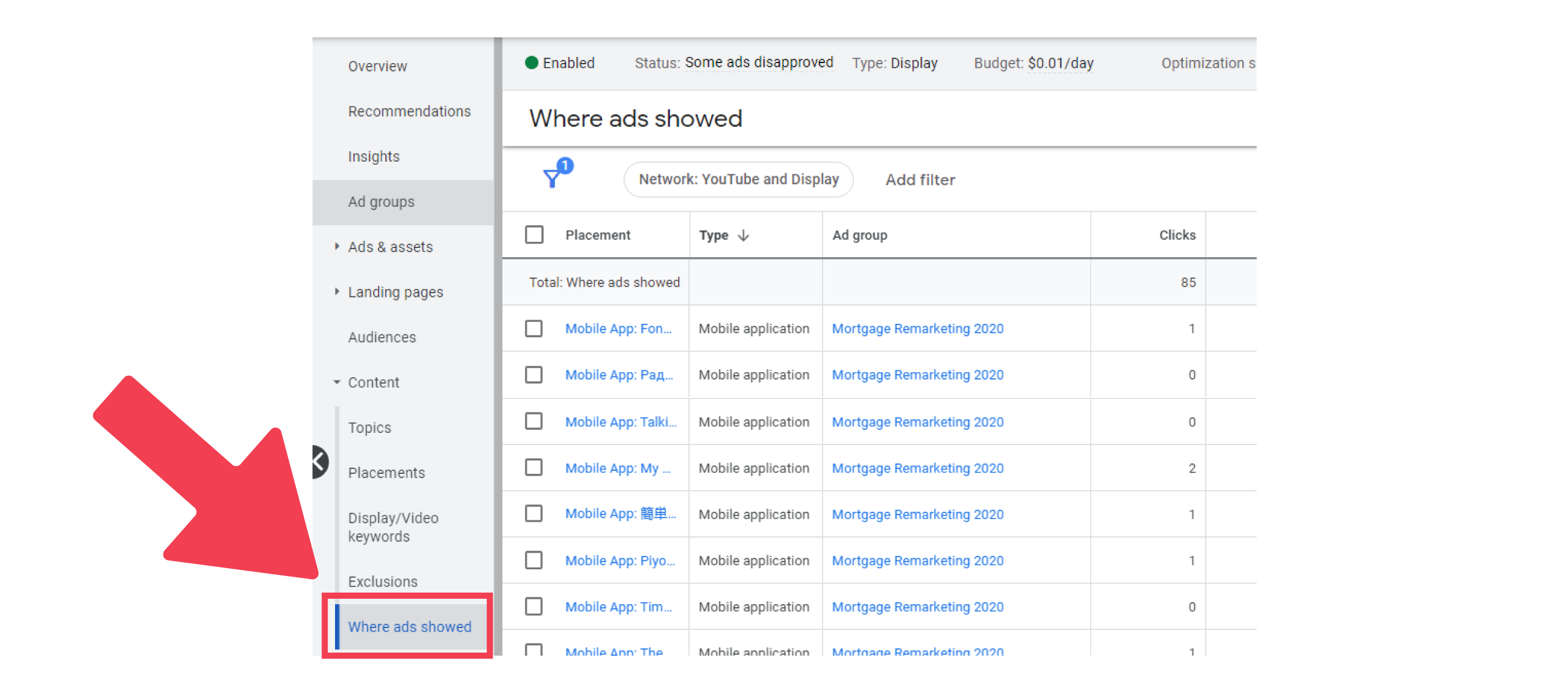

10. Manage where your display ads are seen

With digital marketing, you can manage where your ads are displayed. We recommend going through the list and seeing in which locations you are getting clicks. If you are getting clicks on sites that are spam-ish or on a page that you don’t want your ads to appear on, you can click a box and have your ads excluded from that website. Your ads may appear on thousands of websites, so it isn’t realistic to go through every one of the sites you appear on, but you can ensure you are paying for good clicks by excluding those bad websites.

Do you need help pivoting your marketing?

At BankBound, we are financial marketing nerds. We focus on helping financial institutions improve their digital marketing efforts and help them see success. Take the next step and request a no-pressure consultation to talk with a strategist about your digital marketing plan today!