Integrated Marketing

Your financial institution is being acquired. Ok, perhaps not. But what happens if or when that day comes?

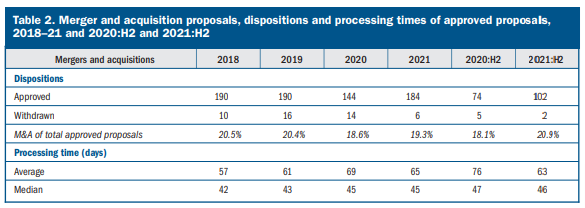

There were 184 approved M&A proposals in 2021, according to the most recent semi-annual report from the Federal Reserve (Fed). That number is an increase of 27% from 2020 levels. Additionally, 64% of approved M&A proposals involved financial institutions with less than $1 billion in assets.

As you can imagine, the BankBound team has seen more than a few clients involved in M&A activities – on both ideas of the deal. Therefore, given the return to pre-pandemic levels of M&A activity with our core client base, we thought it may be helpful to share some of our insights. In this article we will discuss what you may expect and how you can leverage your digital marketing agency partner.

Source: U.S. Federal Reserve, Banking Applications Activity Semiannual Report July 1–December 31, 2021, published August 2022.

How a Bank Merger Will Affect Your Marketing Team

Bank mergers affect more than dollars, cents, and market share. Your marketing team, particularly the managers, coordinators, and strategists, are going to have their faith and confidence shaken by the merger news. Expect that some percent of your team will leave for new opportunities – quickly. BankBound has seen key client team members leave in as little as two days from when an acquisition is announced.

If this is a concern, we suggest identifying key personnel and finding a way to incentivize them to stay. Have that discussion with executive management sooner than you may realize. This should be done regardless of whether those key people will be offered roles with the new company, or not.

It is in the chaos of staffing uncertainties where your digital marketing agency – aka BankBound – can serve as a safety net.

How a Bank Merger Will Affect Your Marketing Budget

Best laid plans, right? Unfortunately, any plans beyond keeping the status quo are likely unnecessary as soon as the merger news breaks. Your new job is to help keep the lights on, maintain business continuity, and keep customer attrition to a minimum.

Be prepared to present a revised marketing plan and budget to the execute team based on the estimated timeline. They will want to review the plan in concert with the acquiring bank to get a revised picture of the cost of merger-related costs.

As noted in Table 4 above, in 2021, the Fed took an average of 51 days to approve M&A proposals. But that does not take all activities into account. First, the definitive agreement to acquire must be announced. Then the acquiring bank has to submit the actual proposal. So, the clock does not start right away.

The M&A proposal may require as few as three approvals. The first being that of the Fed branch that has jurisdiction over your area. This map of the 12 Fed bank branch districts can be helpful. The second approval is from the Fed headquarters in D.C. The third approval needed is that of your state banking regulator. So be patient.

There are marketing promotions that can be executed while you wait for the merger to play out. The easiest course is to mimic the promotions of the acquiring company. For example, if Bank A (buyer) offers a HELOC promotion featuring a 1.49% APR* promotional rate and a 2.99% APR* go-to rate, then Bank B (bank being acquired) may want to consider making the same offer. Doing this will help ensure the promotion gets approved and make product mapping easier. Offering the same promotions reduces the chance of creating a new negative impact to clients during the system and brand conversion stage of the merger.

More About Product Mapping

We mentioned product mapping, so we should probably cover that a bit more. Product mapping is an activity that you will want to perform early on in the process. Based on our experience, product mapping helps both banks determine how Bank A’s products, services, and fees map to similar items from Bank B. To take the topic a step further, product mapping:

- Helps determine which clients will be negatively affected by the proposed product mapping. For example, if a customer from Bank B (again, bank being acquired) has a money market account offering at 3.00% APY*, they will be negatively affected if their account type maps to an MMA with Bank A (again, the buyer) offering a 1.00% APY. This and any other negative impacts will likely be a must-disclose item.

- Helps the executive team overseeing the merger understand how current customer offerings may impact such metrics such as interest expense. We once saw a merger where one bank offered a 0.90% savings account product while the corresponding account offered by the acquiring bank was 0.05%. The bank offering 0.90% worked to reduce that the interest rate before the merger concluded so that there was less of a negative impact on customers at system conversion. The gradual reduction rate also helped reduce the loss of customers.

An entire blog could be written on this single subtopic, but it is probably best to consult your CFO for more information.

What To Do After The Bank Merger Has Been Announced

Identify Your Team

As the acquiring bank (A), you will want to establish a good working relationship with the other bank’s (B) marketing team. You may find, however, that Bank B’s marketing team does not own deposit and lending products in the same way that Bank A does. Look to identify who in the organization has the in-depth product knowledge required to perform product mapping.

Find a Merger Communications Vendor

Believe it or not, there are communication agencies that specialize in bank merger communications. They are familiar with approval timelines, disclosure requirements, how to best convey product mapping decisions, branch closure notifications, direct mail best practices, and more. They are also expertly skilled in analyzing customer data and manipulating massive spreadsheets for the purpose of variable data insertion into letters and product mapping booklets. Finally, they employ professional writers. All told, re-allocating some of your marketing budget to a bank merger communications firm is worth every penny. You will sleep better at night, trust us.

Top 6 Ways Your Digital Marketing Agency Can Support Your M&A Project

Email Marketing

Your email marketing (or marketing automation) solution can be incredibly helpful for merger communications. The direct mail letters and packages you send to customers are wonderful (and required), but there is one woeful truth: most of your customer will not read them. You can leverage your digital marketing agency with sending customers advanced notification, via email, of soon-to-arrive merger communications.

If your email marketing platform includes marketing automation, you should also be able to trigger email drip campaigns to customers who visit your dedicated merger information webpage.

Your Website

Early on in the merger process, it will be necessary to identify any changes that will need to be made to Bank B’s website at Legal Day 1. LD1, as it is known, is the day that Bank A officially owns Bank B. To effectively prepare for LD1 changes, we suggest establishing a staging site, a mirror image of your website where LD1 changes can be made and approved in advance. If you do not do this, someone on your team will have to login to your website as midnight on LD1 to make all of the necessary changes. That is not fun for anyone – trust us.

Your agency can help set up the staging site and execute the necessary changes. The hosting company can then update your website DNS settings when the merger is official.

So, what are these necessary changes?

First and foremost, it’s important to set up page-level redirects for your new website. This means redirecting Company B’s mortgage webpage to Company A’s mortgage webpage and not lazily sending everyone to Company A’s homepage. A digital marketing agency (like BankBound) can implement page-level redirects (301 redirects) which will help minimize SEO loss.

After this process, your website should contain the best of both companies. Bankbound can then monitor specific page performance, organic search results, and keyword positioning in search results in order to gauge the effectiveness of your integration and make continuous optimizations from there.

PPC Ads

Google Ads and Facebook ads are a terrific way to announce the merger after system conversion is complete. With Google Ads, BankBound can deliver “welcome” ads to anyone searching for the former bank’s brand name within the old footprint or CRA assessment area. Similar campaigns can be executed via Facebook ads and Bing ads.

Off-Site SEO

Most likely your merger or acquisition has resulted in rebranding with an updated company name and logo. The first step in updating your web presence is adding new content and brand imagery to your website. Once you’ve rebranded yourself, it’s time to reach out to local listing sites such as Google My Business, Bing Places, Yelp, Yellow Pages, and US Bank Locations to verify that these accounts accurately portray your new brand.

Transferring or establishing control of Google Business Profile location listings can be incredibly time-consuming. Your digital marketing agency regularly works in GBP, Apple Maps, Bing, Factual, Yelp, and other online directories. Let your digital marketing agency handle citation management issues while you focus on in-branch signage and other deliverables.

Social Media

Your social accounts are next. It is imperative to rebrand them with the updated company name and imagery, address your audience with a formal announcement of the merger or acquisition, and combine existing social accounts. Focus on the major social platforms – Facebook, LinkedIn, Twitter, and Instagram – for these changes. Digital marketing agencies can strategize and implement the best method of introducing and describing the new brand to your customers. The goal is to create a closed loop that leaves no ambiguity about which company your customers are banking with.

Backlink Analysis

The Internet is filled with backlinks, which lead to and from other websites. In fact, the more backlinks you have, the greater your SEO. After the merger or acquisition, you may have old links sitting stagnant on the web. BankBound can determine which websites are linking back to your website. We prioritize this list by importance to your business and contact these sites to request they change their link to the new URL. Not all websites will respond to the request, but this effort is important for retaining the SEO value of these existing links.

BankBound is here to help!

The risk of losing your web clout looms on the horizon during a merger or acquisition. Careful planning and execution of a digital marketing plan will help you not only survive the transition but glean valuable content and SEO from the other bank. If you can capture the content and connections that drive traffic, the old website can provide a long-lasting boost to your existing SEO.

Is your financial brand being acquired? Is your bank deploying an accretive growth strategy? Talk to a BankBound digital marketing expert for help working through LD1, systems conversion, and beyond. We are going to sleep well at night if you contact us or not. Will you?