Google Business Profile

The banking sector has witnessed a sweeping transition towards digital banking, emphasizing the importance of online customer interactions. With services like online account openings and loan applications becoming increasingly prevalent, financial institutions are recognizing the need to improve their digital presence. Utilizing platforms like Google Business Profile, formerly known as Google My Business (GMB), is essential in this digital pivot. It serves as a vital touchpoint for customers engaging with banking services online, ensuring that institutions remain visible and accessible in a competitive digital landscape.

Why is Google Business Profile Important To Your Bank?

To understand the importance of Google Business Profile you must first understand why Google is important. Here’s why you should care about Google:

- 92% of online search traffic is conducted via Google.

- About “4 in 5 consumers use search engines to find local information”

- 60% of smartphone users contacted a business directly through the “click to call” option on search results.

As a bank marketer, you should care if your bank or credit union is not showing up on local Google searches or Google Maps because chances are, your competitors are.

What is Google Business Profile?

Google Business Profile is a free tool that allows businesses the opportunity to manage how they are represented in Google Search and Google Maps. The information you provide determines your eligibility to show up for local searches. A better profile means better Search Engine Optimization, specifically bank and credit union SEO. So, the more complete your Google Business Profile, the more likely you are to show up.

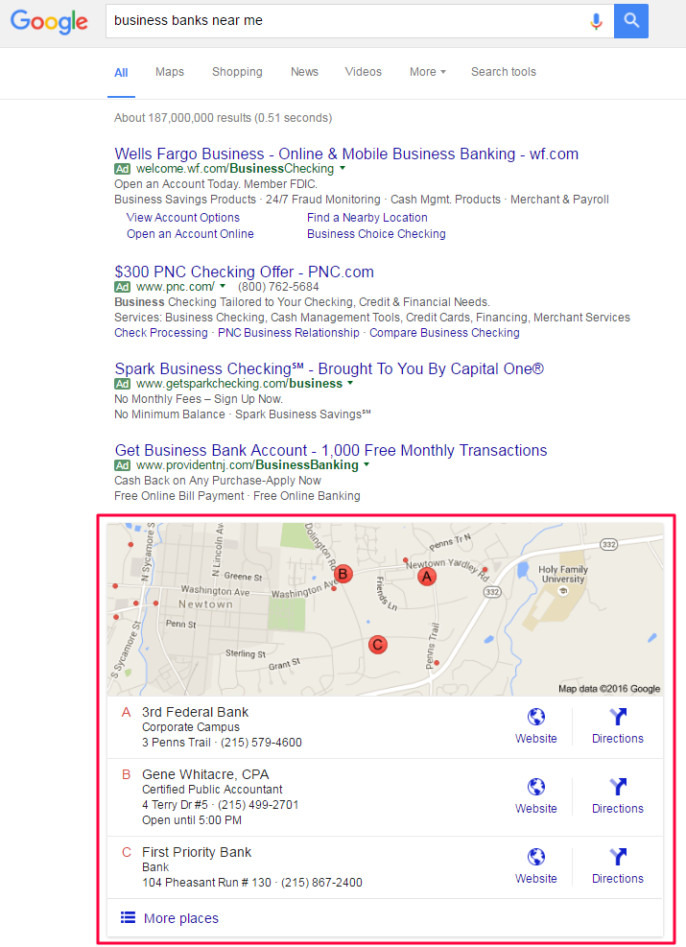

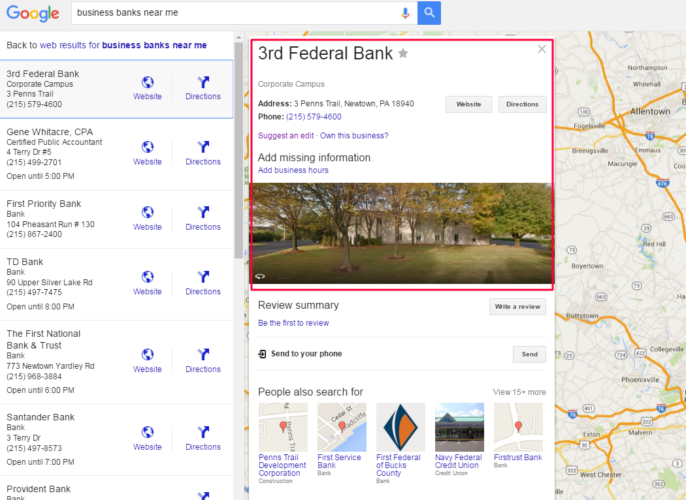

If your profile ranks as one of the top three search results, you will show up in the “local pack” (also known as a map pack). The local pack shows up right after Google Ads and before other organic search results.

Here is how the information you provide shows up in a local pack:

Showing up in the local pack can give you a huge advantage over the competitors. From the map pack, users can learn more about your business, visit your website, or get directions to their local branch.

Why Your Bank Needs Google Business Profile

Your Google Business Profile is the first thing that comes up when someone searches for your business. It’s also one of the first places customers look for up-to-date information about your company. Failing to claim, fill out, or even create a listing can leave customers frustrated and confused. If you don’t show up at all, it can leave them second-guessing your business.

The biggest advantage of being a local bank is that you are in fact local. Customers and prospects see your branches on their way to work, they meet your team at community events, they have friends work for you. Your bank is a crucial part of your local community. Why not reaffirm your presence as a local, community bank by taking advantage of all the free features available through Google Business Profile. There are many ways to optimize your Google Business Profile to increase your local rankings, but first, let’s talk about how to set up your profile.

Set Up A Google Business Profile Manager Account For Your Bank

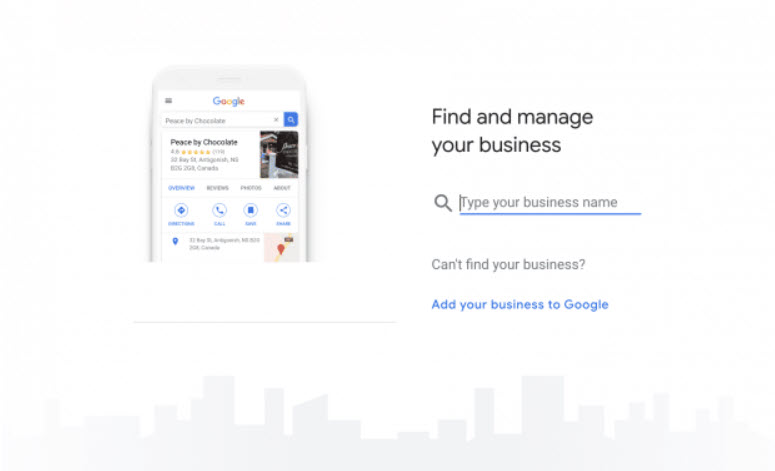

If you see that your bank is already showing up in the local pack or Google Maps, you can claim the individual listing, but it’s much easier to manage and control the information when you claim and manage your listings with a Google My Business account.

To create an account, head over to your Google Business Profile account and sign in to your bank’s existing Google account, or create a new one. To avoid future headaches, set up a generic Google Account that’s accessible for your team and not tied to a single person. If you’re able to use a generic corporate email address (like marketing@yourbankdomain.com) this can often expedite the verification process. Choose any Google username you want, but don’t use your bank name in the “first” and “last” name fields since this will create a “personal” Google for your brand name that can cause confusion in YouTube and other Google profiles.

How to Claim or Add Your Bank’s Google Listings

If there is an existing profile, whether created by someone at your bank or a Google user, you can claim your profile. If there are no existing Google Business profiles, Add your business name. Google will ask for basic information about your business including address and phone number. During the last step of the process, Google will ask you to “Verify your business”. Google will verify your bank is a legitimate business by sending a postcard with a verification code to the address that you provided. If you will not be at this location, let someone there know to expect the postcard and to provide you with the verification code once it arrives. Postcards usually arrive within 14 days. If you do not receive yours within that time, you can request that another postcard be sent.

Once you have the code, log in to your Google Business Profile account and verify your listing. When sending out postcards, you must send them to the exact address of the bank. Google does not send verifications to a P.O. Box.

You will need to claim and verify listings for each bank location. This is one of the reasons why Google Business Profile is a wonderful resource for local banks. When a customer or prospect searches your bank by name, the information or the branch closest to them will show up in their search results.

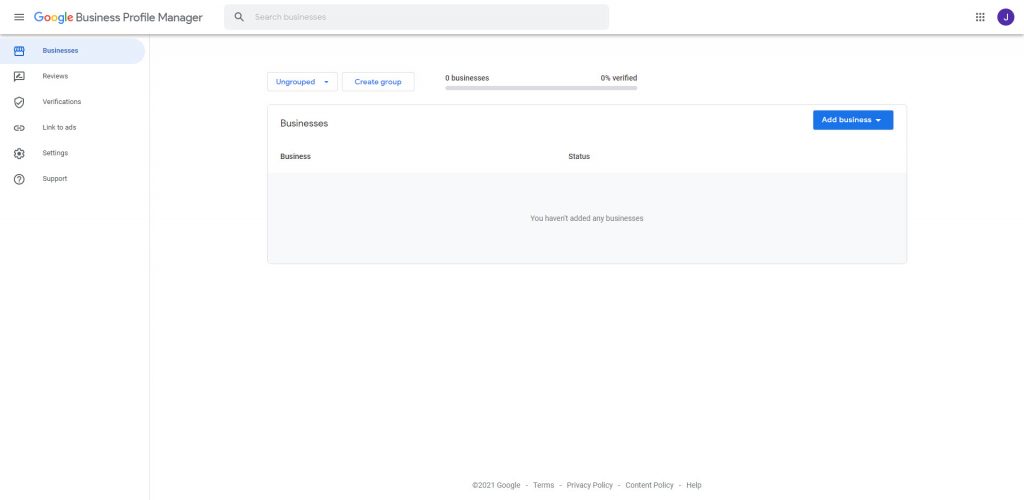

Once you’ve claimed an initial location, search and claim or add any remaining locations. You can add a listing by clicking the blue “Add business” button and select “Add single business”.

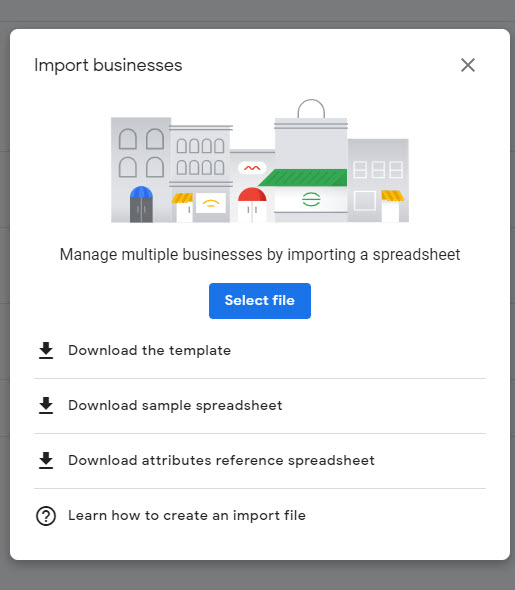

Google Business Profile Bulk Verification

If you have 10 or more locations, you can set up your Google Business profiles using the bulk verification method. To use the bulk verification feature, click the “Add business” button and click “Import businesses”. Download the template and populate it with the information for each branch. Do your best to ensure every available field is accurately completed for each location. For details on each of the fields included in the import file, you can refer to this Google Support page.

When you’re ready to upload, navigate back to “Import businesses” and click the “select file” button. Upload your completed spreadsheet.

Build Out Your Bank’s Google Business Profiles

Once your profile is claimed, it’s time to build out your bank or credit union’s Google Business profiles. For each location, fill in:

- Business Category

- Service Area

- Hours and Drive-Thru Hours

- Appointment links – If you don’t have a special page where visitors can request an appointment, consider linking to your “Contact Us” page.

- Accessibility information

- A description of your financial institution. If there is anything special about a specific location, mention that here.

- Photos

- You can also consider adding your bank’s products to the “Products” section with corresponding images. Use your own images instead of stock images.

Optimizing Traffic Analysis: Tracking Visitors from Google Business Profile

To track visitors to your profile pages effectively using details from your Google Business Profile, follow these steps:

Use Google URL Builder

This tool allows you to create custom URLs for your website. By using it, you can better understand how users are reaching your site from your Google Business Profile.

Set Campaign Parameters

In the URL Builder, set ‘gmb’ as the campaign source. This identifies that the traffic is coming from your Google Business Profile. For the campaign medium, use ‘organic’ to indicate that this is organic traffic, not paid.

Link to Specific Location Pages

If your business has individual location pages for each branch, create custom URLs that link directly to these pages. This gives you more detailed tracking information about which branch’s profile is driving traffic.

Fallback to Homepage:

If you don’t have separate location pages, link to your homepage instead. While this provides less specific tracking data, it still gives insight into the overall effectiveness of your Google Business Profile.

It’s important to note that while adding UTM parameters is helpful, it’s only a partial solution. Currently, there isn’t a straightforward, free method to integrate all Google Business Profile data directly into Looker Studio or GA4 (Google Analytics 4) for comprehensive reporting. However, UTMs still offer a practical way to track and analyze the performance of your Google Business Profile in driving traffic to your website.

Why is it so important to optimize your Google Business Profile

The importance of your business ranking well in Google Local results is evidenced by the high search volume for queries that trigger Local listings. Here’s a few that trigger bank listings:

- “banks near me” – 823,000 monthly searches

- “credit unions near me” – 368,000 monthly searches

- “local banks” – 12,100 monthly searches

- “local credit unions” – 9,900 monthly searches

- “closest bank” – 3,600 monthly searches

These monthly search volumes reflect Google searches conducted nationwide, but even on a local level, you can expect these queries to produce enough interest to be worth caring about. It’s also worth pointing out that on occasion, banks that have very generic names or who share a similar name to another bank might see other banks showing up in Google Local results for branded searches. Without properly optimized Local listings your own customers may end up finding another bank’s listing while they’re attempting to find you!

Google Local Optimization Best Practices

Completing your business profile and sharing posts are just a few ways you can improve the visibility of your bank or credit union’s local listing. Here are a few more best practices for optimizing your Google Local listing.

Perfecting Your Presence: Ensuring Accuracy in Google Listings

Google wants to provide users with the most relevant results, so take the time to get your listings right and update when necessary.

Harness the Power of Praise: Amplifying Customer Reviews on Google

You already know that your financial institution is amazing, so help Google (and everyone that uses Google) know just how amazing with real reviews from actual customers. Reviews have an enormous impact on people researching your brand, thus Google also values reviews greatly. Not only should your bank be soliciting reviews, but take time to respond to negative reviews and thank users who leave positive reviews.

Citation Supremacy: Outranking Competitors with Superior Directory Presence

Citations are listings of your business on other website directories like YellowPages, Yelp, and Manta. These data providers aggregate information from various sources and likely already have information posted about your locations. It’s a tedious job, but claiming each citation for all of your branches across popular websites will establish consistency which is a big ranking factor for Google.

Strategic Categorization: Maximizing Impact with Google Listing Categories

Google and other local networks like Bing often allow businesses to choose primary and secondary “categories” to classify their business. Choosing multiple categories for your listings is a good idea when possible, but only if those categories accurately reflect what you have to offer at each location. And don’t forget, ATM locations are also eligible for their own Local Listings and should be claimed as part of an effective ATM marketing plan. Relevant Google Local categories for financial institutions include:

Bank, Bank or ATM, Investment Bank, Investment Service, Savings Bank, Credit Counseling Service, Credit Union, Federal Credit Union, Money Order Service, Money Transfer Service, Loan Agency, Check Cashing Service, Mortgage Broker, Mortgage Lender, Financial Consultant, Financial Institution, Financial Planner

Map Your Success: Integrating Local Listings with Your Website

As a best practice, your bank or credit union should have individual pages on your website for each branch location. Within each location page on your website, you’ll want to make sure you embed a Google map that links to the corresponding Google Maps listing. Implement location-based schema on your website’s individual location pages, especially on the name, address, and phone number of each location (NAP).

Expand Your Reach: Link Your Social Media to Your Google Business Profile

Embracing the full spectrum of digital engagement is important for financial institutions. It creates a comprehensive digital footprint that not only increases visibility but also offers customers a direct path to interact with your brand’s social narrative. Adding social media links to your Profile invites users to connect with you on various platforms right from their search results, fostering a sense of community and accessibility. This step strengthens your institution’s online reputation and nurtures enduring customer relationships by promoting consistent and engaging communication across all digital touchpoints.

SEO Mastery: Elevating Your Website for Better Local Google Rankings

A big Google Local ranking factor is how well your website ranks in organic results. The more relevant your website is for a local search query, the better your chances to rank well in local results. To improve your website’s organic rankings, focus first on a smart “localized” content marketing strategy, then make sure your website is using technical best practices for Google search optimization, and finally look for opportunities on other relevant websites to acquire backlinks or brand mentions.

Local Flavor: Tailoring Your Google Listings for Community Relevance

This is missed surprisingly often by local businesses who take the time to claim their Local listings! Help Google understand how relevant your local business is to a local user by using a local phone number (not an 800), mentioning town names in your listing description, and linking back to the corresponding location page on your website instead of the homepage. Additionally, many local businesses often include the location of their listing in the “business name” field (for example YouBankName – Newtown). This is technically against the Guidelines for representing your business on Google, but we’ve never seen any action taken by Google against businesses for utilizing this tactic.

Detail-Oriented: Completing Your Google Listings for Optimal Visibility

Take the time to get all the details filled out on each location, including hours and as many high-quality photos as you can for each photo category. Write out a full description that is unique for each listing.

Mobile Momentum: Ensuring Your Website’s Mobile-Friendliness for Better Ranking

For many reasons, including Local rankings, your website should absolutely be mobile-friendly.

Eventful Visibility: Leveraging Google Business Profile for Special Occasions

Having a grand opening, or another special event at your financial institution? Create an event in Google Business Profile so it will show up as part of your GMB profile in search results.

Boost Your SEO Brilliance: Leveraging Posts for Increased Online Traffic

– Share your bank’s blog posts in the “Posts” section. This is another way to increase your blog’s visibility and get more traffic to your website. Use the Google URL builder so this will show up clearly in reporting.

Enhancing Your Banks Google Local Listing with Compelling Photos

The Visual Advantage: Why Photos Matter in Your Google Local Listing

In today’s digital landscape, visual content plays a crucial role in engaging and attracting customers. For financial institutions like banks and credit unions, adding high-quality photos to your Google Local listing can significantly enhance your online presence. Photos provide a visual narrative of your brand, offering a glimpse into your facilities, services, and the overall customer experience. They can help in building trust and authenticity, giving potential customers a real feel for what to expect when they visit your locations.

Examples of Impactful Photos for Your Listing:

- Exterior Shots: Capture the exterior of your branches, ideally during different times of the day. This helps people recognize your building when they visit.

- Interior Views: Showcase the interior of your branches, focusing on the customer service area, waiting lounge, and any unique features that enhance customer experience.

- Team Photos: Include professional pictures of your staff, both in group settings and individual portraits. This humanizes your brand and builds a connection with potential customers.

- Service-Specific Images: If you offer specialized services like safe deposit boxes, financial advisory, or loan consultations, include photos of these areas or related paraphernalia.

- Community Involvement: Photos from community events, sponsorships, or charitable activities can illustrate your institution’s commitment to local causes and community engagement.

- Technology and Facilities: Showcase any advanced technology, ATMs, self-service kiosks, or unique facilities that set your branch apart.

- Promotional and Seasonal Décor: If your branch decorates for holidays or seasons, or if you have promotional displays, include these photos to show your institution’s dynamic and engaging environment.

Best Practices for Photo Uploads:

- Quality and Clarity: Ensure all photos are high resolution and well-lit.

- Regular Updates: Keep your photos up to date, especially if there are changes in your branding, interior design, or staff.

- Diverse Representation: Show diversity in your team and clientele photos to resonate with a broad audience.

Local SEO Beyond Google Business Profiles

Although more than 90% of search traffic comes from Google, you should still consider building out Bing Place’s, Microsoft equivalent to Google Business Profile. The process is very similar to Google. You may also want to consider building Facebook pages for each bank location and creating Yelp listings. The more resources you utilize to establish your financial institution as a local bank, the better your chances of showing up in local searches.

Need help managing your local listings? Check out BankBound Local for listings management, review marketing, and more!

Learn more about marketing your local bank. Get the Digital Marketing Strategy for Local Banks.