Bank Marketing Strategy

At most companies, marketing expenses are agonized and debated over. Companies rely on well-crafted marketing strategies to gain new customers and retain current customers but quantifying those results can be difficult. It’s only after they’ve experienced professional marketing expertise that many companies begin to truly value their marketing dollars.

For banks and credit unions, there are special considerations that need to be taken into account when it comes to marketing efforts. Is it better to outsource or handle marketing internally? Can we find an agency that knows how to reach new customers, grow deposits and increase engagement with our current customers? Will an agency utilize strategies that could tarnish our reputation?

These are all legitimate concerns, but you can put yourself at ease by doing some research before selecting an agency. To help you through this process, we’ve outlined a few of the pros and cons of outsourcing your financial institution’s marketing efforts and identified ten questions to ask yourself before settling on an agency.

Should I Outsource My Marketing?

The marketing solution you need can take three forms: hiring in-house marketing employees, assigning marketing duties to current employees, or outsourcing your marketing jobs to an experienced marketing firm. For many companies, outsourcing is more cost effective than creating an in-house marketing position. By outsourcing, you save the money you would spend not only on salary but on taxes, benefits, training, and office equipment. Here’s a look at the other benefits of outsourcing your bank’s digital marketing.

Save Time

Ever feel like your whole day is filled with meetings and conference calls? A good digital marketing company is going to take your vision and run with it. You won’t need to manage them the way you would in-house employees. An outside firm will provide you with a single point of contact to help streamline marketing communication. Rather than managing the day-to-day activities of an in-house marketing team, your marketing contact will manage the meetings and updates coming from your outsourced marketing staff.

Expand Your Expertise

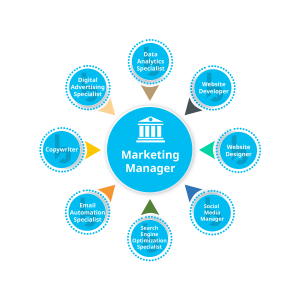

Unless you plan to develop an entire marketing team within your bank, your in-house marketing employees will be limited in their skill set and availability. An outside marketing agency employs a variety of experts in different marketing fields. SEO specialists, copywriters, and website designers are just some of the professionals working for you when you outsource. You don’t need to become an expert or hire an expensive full-time expert. By partnering with a marketing team, you get a wide array of skills and expertise at your disposal when you need it. There’s added benefit if you can find a marketing firm with extensive knowledge of your market and industry. Marketing strategies are always evolving, and you’re busy running your bank. An outside marketing firm will stay on top of new trends and best practices because that’s their business.

Get Objective Feedback

Most businesses need an outsider to make sure their message is understood by the public, and this is especially true for banks and credit unions. Financial terminology, jargon, and procedures can be complicated to the layman. Your employees are used to hearing these words, and it can be difficult to take a step back and be sure your marketing message is being received by your audience. An outside marketing team can provide an objective viewpoint on your content that you won’t necessarily get from someone who is part of your organization.

Build a Strong Relationship

A dedicated marketing team is a business partner whose success is tied to yours. A good agency will provide ongoing suggestions and tactics to bolster your marketing efforts. Since they are not full-time employees, they must continually earn their position with you by providing quality results. An outside agency will continually be looking for ways to boost your image, reach your targeted customers, and retain your current clients.

Benefit from Shared Intelligence

If you’re lucky enough to partner with a marketing team that knows the in’s and out’s of banking, you’ll benefit from ongoing marketing research that pertains to your market and products. Agencies like BankBound are constantly testing and implementing new marketing strategies created specifically for banks and credit unions. Because all of our clients are banks, they all benefit from the information we gain from this ongoing research.

Is There A Downside to Outsourcing?

Like any decision, the question of whether or not to outsource your digital marketing can present some negative points. After all, you’re committing funds to an outside source and trusting another company with your brand image and reputation. Let’s take a look at the possible downsides of outsourcing your marketing.

It’s an Additional Expense

One way or another, you’re going to spend company dollars on marketing. For many, writing that number into traditional employee expenses is easier than seeing a check go out the door to an outside firm. In the end, however, outsourcing will likely save your bank money by cutting out expenses that come with in-house employees such as taxes, benefits, computer equipment, and office space.

What you get from outsourced marketing is going to be more valuable than if you kept that money in-house. When you partner with a marketing agency, you’re getting multiple people with digital specialties. Instead of having to hire an in-house copywriter, designer, SEO expert, PPC manager, social media manager, and more, you can bundle these responsibilities into your one marketing team. This could actually lead to lower marketing expenses for your bank since you won’t need to employ all these individuals full-time. On top of this, an agency is already fully-equipped with an arsenal of marketing tools, like marketing automation, that they’ll put to use on your behalf, saving you the expense of paying for these tools from your own marketing budget and learning how to use them effectively.

They Don’t Understand My Products

No one knows your specific products and services like you do. While this may be true, sometimes you need a third-party to make sure your marketing message is understood by the public. You’ll want a marketing agency familiar with banking and the financial industry. A firm knowledge of banking products is essential to creating the right marketing strategies. BankBound only works with banks and credit unions, so we live in the same world as the financial institutions we serve and understand their products.

I’ll Lose Control Over Marketing Information

For some, the idea of handing off marketing responsibilities to another company can be daunting. It’s a double-edged sword – you don’t want to spend your time managing marketing operations and you also want to know what’s going on and how your money is being spent.

What you need is an agency that values transparency and provides you with a dedicated account manager that you can trust. A good account manager will serve as your point of contact when you interact with the marketing team. You won’t have to spend your day communicating with several different individuals or departments in order to stay informed. Because your account manager is an outside employee, they’ll need to provide exceptional service in order to get and retain your business. A good outsourced agency will ensure that you see the value in their work by providing transparent communication and reporting to show how they are helping your FI grow. This gives you more time to focus on running your bank without losing control over your marketing efforts and the ROI you’re getting for your marketing dollars.

I May Choose the Wrong Marketing Agency

You may fear getting stuck in a business relationship that doesn’t yield positive results. As with any decision, you’ll need to do your research before choosing a marketing agency. Don’t let the risk of a negative partnership keep you from reaping the benefits of a good marketing partner. If you do your due-diligence and interview potential candidates, you’ll find the right agency to lead you to marketing success.

10 Questions to Help You Choose the Right Marketing Agency

When it comes to maximizing the return on your marketing budget, your best choice is an outside marketing team that is familiar with the banking industry. You’ll gain expertise in multiple marketing specialties without having to create an internal marketing department. You’ll save time and remain focused on the banking departments that you know best. A good agency will develop a relationship with your bank and provide objective opinions regarding your marketing materials. In order to help you choose the right marketing agency, we’ve compiled this list of questions to consider when choosing a marketing partner.

- Do they have credibility & experience within your specific industry?

- What is their approach to client communication?

- Do they understand your products?

- Are their marketing strategies ethical and transparent?

- How do they measure performance?

- Do they understand your customers?

- Will they be a proactive or reactive partner?

- Is their marketing approach data-driven rather than ego-driven?

- Can they effectively communicate marketing strategy and results to your internal stakeholders?

- How effective is their own marketing?

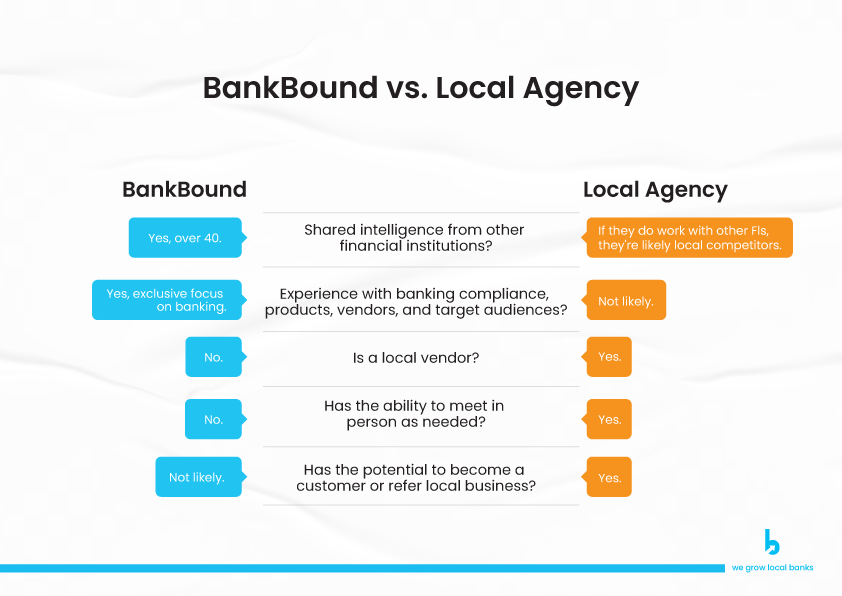

Already have a marketing agency partner? Consider your current relationship with them using the questions above. Are they providing an optimal marketing experience in terms of results and communication? Many local ad agencies and news publications are struggling to adapt to digital marketing. While they may get your name on the web, they don’t employ the same wide variety of digital marketing specialists as other firms. Not to mention the fact that traditional marketing strategies like billboards and print ads can’t be tracked with the same degree of accuracy as digital leads.

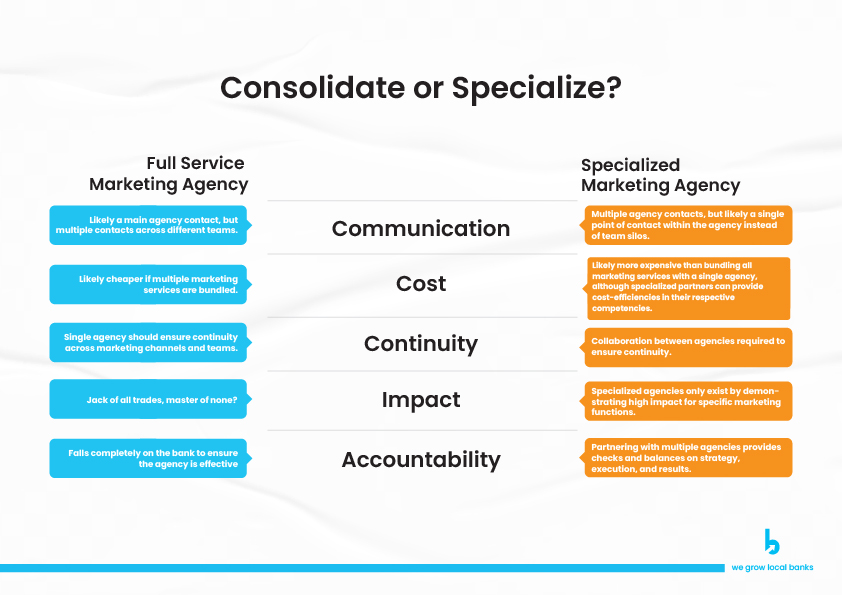

Should We Partner With a Single Full-Service Marketing Agency or Multiple Specialized Agencies?

Should We Choose a Local Marketing Agency or an Agency With Banking Industry Experience?

Get to Know BankBound

If there’s a chance your marketing dollars could be better spent, then it’s time to get to know BankBound. We specialize in digital marketing solutions for banks and credit unions. Our team of financial marketing nerds is happy to answer your questions and provide insight into digital marketing strategies tailored to the financial industry. Contact us to learn how we can take your financial brand’s digital marketing to the next level.