Bank Marketing Strategy

Millennials have officially taken over Baby Boomers as the largest living adult generation in the nation, and is projected to continue to grow as immigrants arrive in the country. As they grow older, they also grow in income and influence. So why do a lot of banks continue to advertise and cater to the older generations? And how can they shift gears and reach the new generation of adults?

Who Are the Millennials?

When looking at targeting a specific generation, it is important to identify exactly who that is. Millennials, also known as Gen Y, are typically identified as being born between 1981 and 1996. This would make them currently aged between 27 and 42 years old.

It is also important to understand how technology has influenced the ways millennials navigate their adult lives. Ask any millennial, and they will have a hard time remembering a life before internet chat rooms and AIM. They’ve always been able to “Ask Jeeves” a question and have a world full of answers populate on their screen. They want quick blurbs of information, and they want it to be easy to find – Google has been providing them information like this since 1998.

How Do Millennials Interact with Businesses?

This generation does not interact with the world in the same way Gen X or Baby Boomers do. Do not expect them to research, shop, or engage in the same manner.

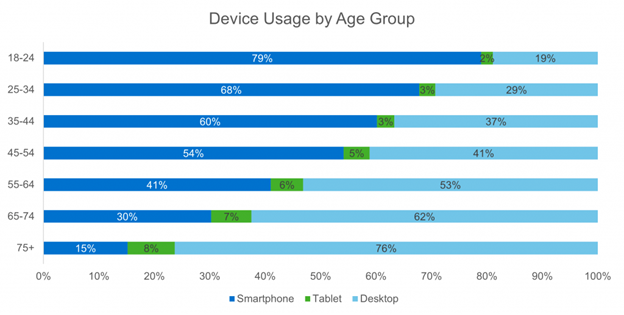

Millennials are much more likely to use a smartphone to search and engage, vs a desktop or laptop. This means your website must be responsive and optimized for viewing on a mobile device. If your website takes too long to load, or is busy and hard to navigate, a millennial will click away and go to a competitor.

Millennials are also averse to picking up the phone and calling a representative. In fact, according to research, “34 percent of them would rather have their teeth cleaned” and “26 percent would rather go

to the DMV.” If your website only offers the ability to call, you are negatively influencing a millennial to do business or open an account. In a world where online-only bank accounts are becoming more common, and brands such as Apple are growing deposits by offering their own savings accounts, brick-and-mortar banks need to become adaptable and offer services through online banking and portals, vs requiring a phone call or location visit.

Your conversions and engagement metrics will look different when targeting a younger demographic. Make sure to track non-call metrics as well. How many users clicked to email, or to apply online? (check out these best practices for increasing online account opening) How many customers read more information about your digital banking offering? How easy are you making it for customers to use digital banking? The more accessible you make your products and services, the more business you will see from Millennials who will not hesitate to move to the next competitor.

Where are Millennials?

Once you understand that the Millennial is online and available more than previous generations, your plan of marketing should change. Traditional advertising is no longer as relevant, as digital marketing and search engine optimization become critical. 71% of millennials engage in social media on a daily basis, and spend an average of 5.4 hours per day on user-generated content. This makes it not a question of if they’ll see your message or brand, but if they’ll find it relevant and engaging.

Do not be afraid of getting social. Interacting with your customers on social media builds credibility and authenticity with a millennial base. Gen Y wants to do business with a brand that understands them, comes across as more than just a business, and treats them with respect. Use social media to educate and connect with your customers and potential clients, not just to advertise and try and get their business.

Some platforms we recommend starting with:

- Facebook – At this point, if your bank is not on Facebook, you are playing catch up- and will need to sprint to catch up. Still the largest social media platform, Facebook grew 12% in usage year over year from 2021 to 2022.

- Instagram – Social media experts expect to see Instagram grow the most in 2023, with the most accurate algorithm and best potential to grow your audience. Make sure you are differentiating your posts – while Meta offers you the option to post the same on both Facebook and Instagram, the audience will be different. Do your research and tailor your content to each individual audience.

- YouTube – A study done in May 2022 showed 87% of Millennials had a YouTube account (And Gen Z, the next in line generation, had even more at 96%). YouTube offers you multiple ad options, and is a prime home for educational content. Posting a video from a lender or banker explaining what a HELOC is, or how a CD can give them better guaranteed returns than the stock market can go far in building credibility and trust (more on CD marketing best practices here).

- Reddit – Reddit is a great place to find a customer base dependent on interests. The community is divided into “subreddits”, and as of 2021 there were more than 2.8 million subreddits. Some of the top financial subreddits are r/finance, r/financialplanning, and r/personalfinance. On Reddit, you can create an account and host an “AMA” (Ask Me Anything) or advertise based on subreddit interest.

- TikTok – OK, hear us out. TikTok is not just for dancing and odd challenges. TikTok has evolved into a platform spanning multiple industries, providing information and education. #FinTok (or Financial TikTok) has 3.7 billion views as of this blog writing and is only going to grow. #PersonalFinance has had an incredible 8.7 billion views! Posting short educational videos on TikTok can open your institution to a whole new generation of customers, gaining their trust and beginning them on their financial journey with your bank.

How Can I Get Started?

If you’re ready to get started branching out and offering banking to Millennials, BankBound is here to help! Our team can help you establish your bank’s social media presence and meet your customers where they are. Bankbound can also help you redesign your website to keep up with the digital and mobile age. Lastly, we can help you create content that can educate and help guide your customers. Schedule a call with a strategist today to learn more.