Resource

Social media platforms, much like other digital outlets, are online spaces where people and brands communicate. But with so much hype to contend with, many financial institutions struggle to leverage their accounts effectively.

As social media continues to evolve, so too must our approach. This guide will walk you through the dos and don’ts of using social media in the banking industry. Whether you want to know more about the type of platforms to use and how to manage them, or how to work with social media influencers, we’re here to point you in the right direction.

Before we get started

We need to mention several important reminders about what social media is not.

Firstly, no matter how successful your organic social media becomes, it will never be your highest performing digital channel. The return on investment (ROI) will likely be one of your lowest. According to a study by Hootsuite, only 6% of your Facebook followers will see your post, with the average Facebook page seeing as little as 0.07% engagement.

As a result, organic social media should never be the center of your marketing efforts – this honor should go to your website. All of your social posts should drive people to your site since you own that content and can control the experience that your visitors have there. Think of your website as your 24/7 branch office.

Remember that social media is not broadcast marketing. Instead, it’s an opportunity for dialogue between yourself and your customer. Always ask yourself how interactive your posts are and how you can encourage more comments, tagging, sharing, and liking. If the majority of your posts until now have been generic stock photos for a random holiday, it’s time to reconsider your strategy.

Become part of the conversation

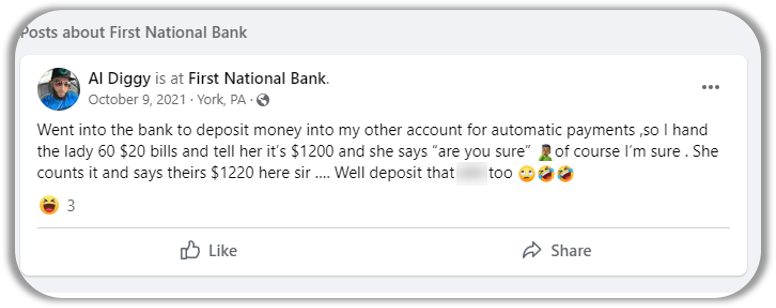

Discussions around your brand are already happening on social media, whether you’re actively involved or not. Your channels allow you to join that conversation and represent your brand accurately. Even if you’re not fully engaging in dialogue at this point, creating a consistent brand image is the minimum that you should be focusing on.

When you’re ready to jump in, there are a few best practices that you should follow:

- Be Genuine: stay true to your brand

- Be Helpful: help first, sell second

- Be Careful, But Not Absent: sometimes silence speaks as loudly as active participation

As with any marketing, you should always have a documented plan in place. Having a backup spreads the responsibility around your team and protects your bank from losing access should an employee leave the company. Your board should also be in agreement when it comes to your efforts on any digital platform. Finally, having a structured plan can help you avoid going viral for the wrong reasons.

There’s plenty to remember when it comes to social media for financial institutions. Having the right perspective and frequently posting isn’t going to make it rain down checking accounts. But people are already out there, talking about your products and brand. So join the conversation with a carefully crafted and documented plan of action.

Understand the role of social media for financial institutions

Running social media accounts involves a significant amount of time and budget. Banking is, after all, a business, so thinking about the value to your institution’s bottom line is necessary. With this also comes the need to consider what challenges social media can bring to your organization.

Unlike your website, you don’t own your social media. As companies like Facebook, Twitter, and LinkedIn evolve, there’s always the potential to lose everything you’ve worked for. Different platforms come and go (remember MySpace, StumbleUpon, and FourSquare?), so it’s important to remember that social media isn’t dependable like your owned media is.

Social media has become very political in recent years, so it’s vital to anticipate possible controversies as you build your strategy. There’s also much discussion about the psychological harm that these sites cause and how they use consumer data. Your customers are part of these discussions, so be mindful of this as you post.

Just like other businesses, social media companies exist to make money. Reach is primarily determined by advertising. You need to pay to play to get the most out of your channels. Add to this the fact that compliance absolutely loves social media (kidding!). It’s not easy to control, not easy to engage with, and not easy to archive.

Thanks to these constantly moving pieces, social media quickly becomes a black hole of time and resources for bankers and credit union marketers. That’s why it’s essential to have measurable goals in place to ensure that your efforts aren’t wasted.

Craft relevant goals for your organization

A long-term perspective is required when it comes to social media marketing. From here, you can break your goals down into short, mid, and long-range outlooks.

- Short range – your social media is an extension of your bank’s customer service. Demonstrate your credibility and focus on a unified brand message.

- Mid-range – focus on growing your followers and building engagement. Social media is dead without dialogue, so share informative content like an employee behind the scenes or ways that you’re investing in your community.

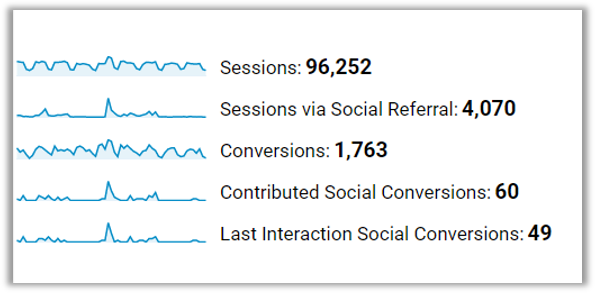

- Long range – engagement alone won’t satisfy board members. Focus on ROI and driving referral traffic to your website to increase tangible leads.

So how do you achieve those long-range goals? The secret here is to have something interesting on your website for your prospects to look at. People on social media aren’t there to be sold to. They want to engage and be entertained or informed. For financial institutions, that type of content could look like:

- Educational content that never ages or goes out of style

- Financial tools like calculators or interactive learning

- Webinars and virtual events

- Product promotions with a focus on benefits over features

Once you have content on your site, creating engaging social posts can be quick and easy.

How to select and prioritize social platforms

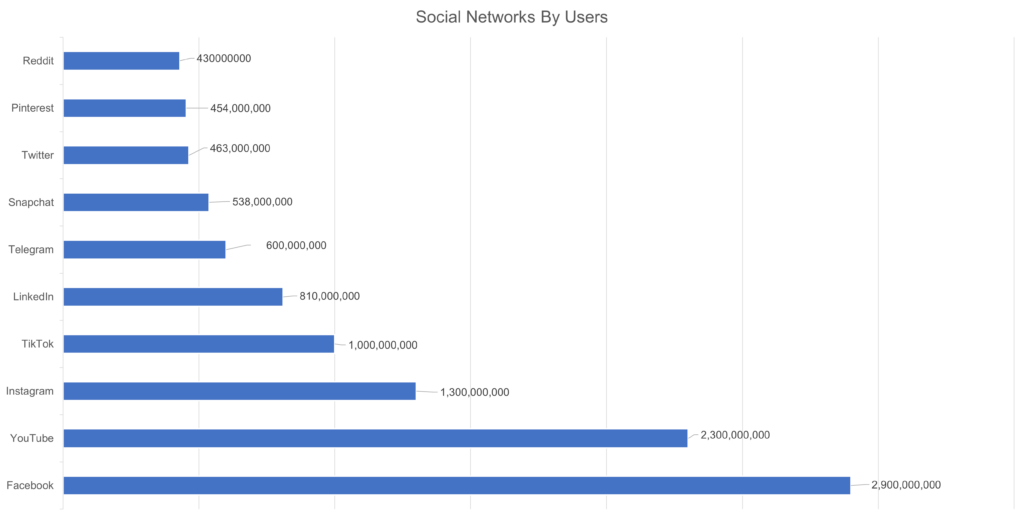

There are countless social media platforms to choose from. While many familiar names are still going strong, social media usage never stays the same from one demographic to another. It’s always worth watching for up-and-coming platforms alongside the tried-and-tested favorites.

Where to start

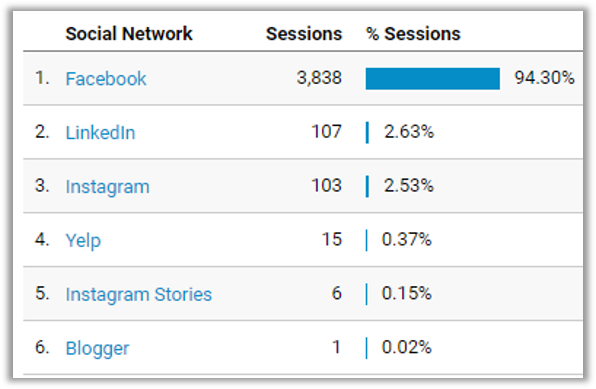

Love it or hate it, Facebook continues to dominate the social media landscape. Most of your consumer and small business clients are already there, whether actively or passively using the site. Retail employees are also heavy Facebook users, a key audience to engage with to extend an already limited organic reach.

However, there are many limitations with Facebook advertising and users are becoming tired of the over-monetization of the platform, hurting efforts made by brands.

LinkedIn is another strong contender that, surprisingly, many financial institutions are still not taking advantage of. It’s an excellent source for recruitment, supporting residential and commercial lenders, and wealth or investment teams. This is the place to engage your shareholders, as well as business customers or prospects.

Employees are active on LinkedIn and are 14 times more likely to share content posted by their employers than on other platforms. But a much smaller percentage of your customers will likely spend time here, so you may need to think of this as a professional networking and recruitment tool instead.

Between Facebook and LinkedIn alone, these two channels have a substantial reach with a large percentage of customers, both business and consumer. Prospective customers expect to see your financial institution present and active on these platforms.

Where to expand

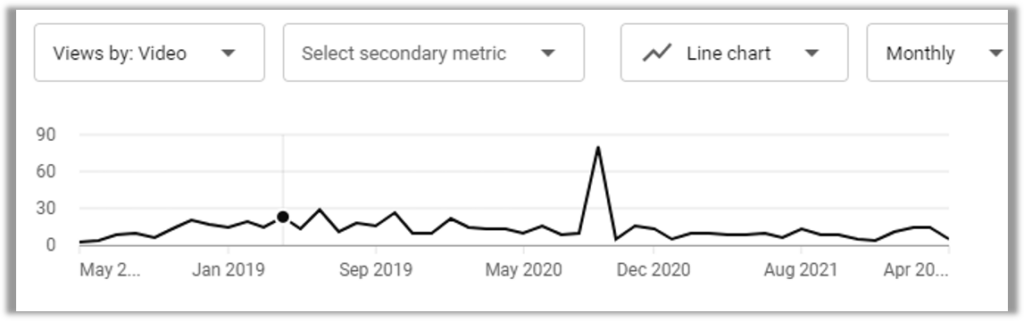

Financial institutions have largely overlooked YouTube. As the second largest search engine, the site is a great opportunity for evergreen content with a much longer shelf life than other social media platforms. Optimization of videos can lead to a positive ROI, even years after publication.

As the go-to destination for educational video content, YouTube can be an excellent referral source for traffic to your website. Although there has been a significant increase in monetization and ads, the platform remains a social media channel worth prioritizing as you look to expand.

Where to experiment

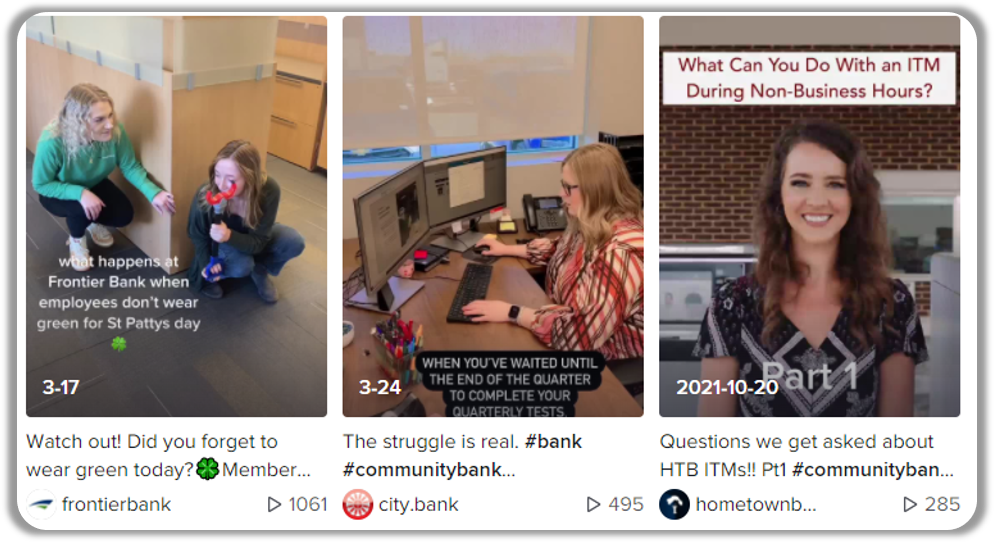

The explosive growth of TikTok makes it an easy channel to test different types of video content. But the site is still highly entertainment-based, so may not be the best home for educational videos.

Instagram is also another platform to consider. Owned by Facebook, consumers and small businesses both use the site. With the right visual content, there’s plenty of opportunity for engagement. But at this point, it’s unlikely to drive any meaningful traffic to your website. Financial institutions struggle to create the right content here, so ROI is limited for the level of work required to maintain a presence on Instagram.

Twitter still commands a high level of utilization for both consumers and businesses and is a potential traffic driver thanks to the platform’s focus on sharing news and links. But this can also lead to controversy. A presence on Twitter often requires additional resources as users look for brand information and timely customer support, which can generate negative impressions of your brand.

Another significantly under-used social platform by financial institutions is Pinterest. Building and maintaining a presence here is relatively easy, and engagement often grows steadily with consistent use. Keeping your content specific and relevant is the key to success on Pinterest, which helps you to target a narrow and niche audience.

There’s been plenty of discussion in the past around brand use of Snapchat to target a younger demographic. Unfortunately, there’s minimal opportunity to drive traffic to your website and the content has, by design, a limited shelf life. User engagement is minimal and Snapchat continues to be a primarily entertainment-focused channel.

Finally, NextDoor can have incredibly high localized engagement, a great opportunity for small, local banks and credit unions. Users come here for referrals and recommendations from neighbors, so there is a chance of traffic being passed through to your website. However, the site is known for its trolling and negative feedback, so it could require higher levels of moderation from your team than other social media platforms.

Build your social content strategy

Now that you have a few platforms in mind, you need to decide what type of content you want to share.

Focusing on people is the best way to engage and create entertaining content – pets are a good extension of this. But instead of posting generic or stock graphics, make use of your employees while keeping your posts on-brand – if you don’t already have a style guide, now is the time to put one together. Celebrate your team by sharing new hires, milestones, or achievements.

Keep your content localized by highlighting customers as they come into your branches or even local businesses that are customers of your bank.

Your content should always be one of the two E’s – educational or entertaining. Find a way to tie your brand back to your community naturally. This could be:

- Historical information using local photography

- Money and finance tips

- Contests and giveaways

- Details about upcoming local events or attractions

Don’t simply cut and paste across social media platforms, though. While this does cut down on the amount of work required, you need to remember that each platform targets a different audience and works best with certain types of content. Knowing what kind of content you can realistically produce can also help you narrow down which platforms to use.

Testing is crucial. Be sure to measure the performance of content on all platforms to understand better what works well on each. For example, live streaming on Facebook and Instagram is, for the moment, a higher engager than static photo posts to your feed. Frequency of posting and time of day should also be noted but should always be based on your content quality, rather than having your content driven by this data.

While it’s still important to post about closures or hours of operation, schedule these updates in advance and work more engaging content around it. Focus on creating dialogue and encouraging comments instead. Learn from and repurpose your successful content to gain more value from each post. Posts around financial literacy, specific holidays, or recurring bank events can be easily tweaked and recycled in later months or years.

How to manage your social media channels

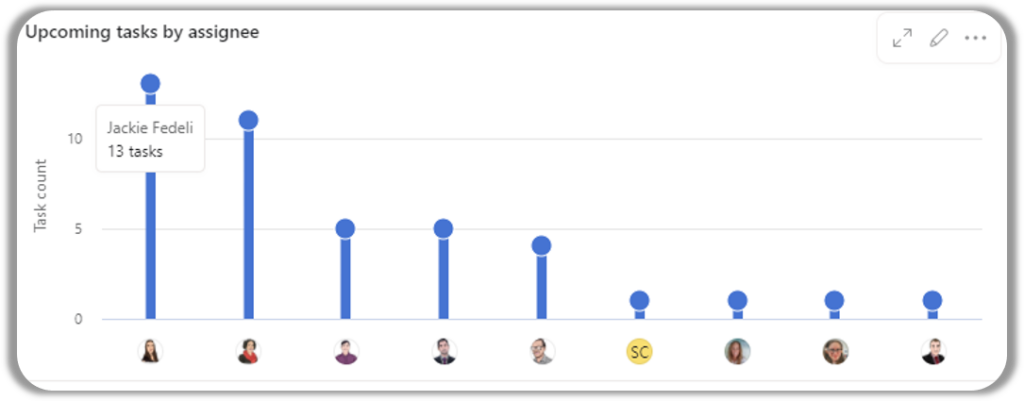

No matter how many platforms you’re using, social media takes time. Anyone can manage your accounts, but how do you decide the best direction for your financial institution?

Working with an agency has several benefits. You’ll have a dedicated account manager to support you, with a streamlined process in place already. If the agency works with other banks and credit unions, their team will have shared knowledge about what works well and what doesn’t.

But since social media is an extension of your customer service, it’s unlikely that they can respond to comments for you. This is still best handled by your internal team. There will also be ongoing work needed on your end, as content will still need to be sourced from the bank itself. It’s also good to remember that social ROI is already relatively low, and this becomes even more difficult to improve once you factor in monthly agency fees.

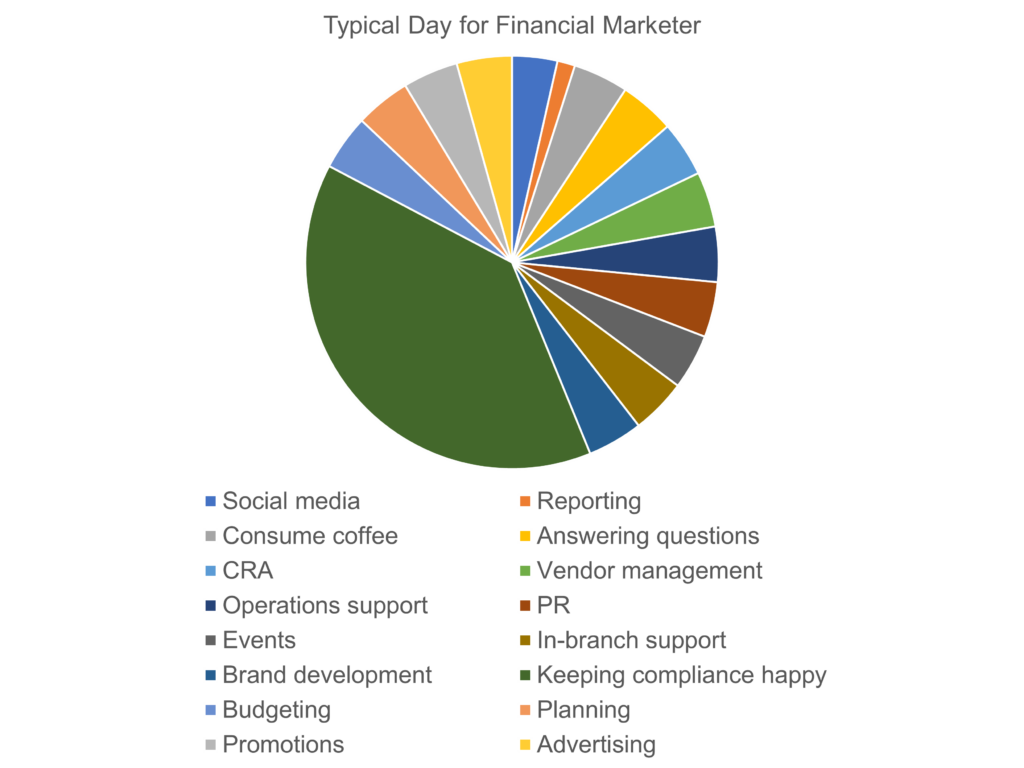

A full-time employee is often the route that financial institutions take. There’s more control with less risk, faster response times, brand continuity, integration with other teams, and less time transferring knowledge to an external support team like an agency. But it can be difficult to justify the cost of a dedicated social media employee with low ROI channels.

While a typical day for a financial marketer is already quite crowded, you may be able to add this as a responsibility to a more general marketing position. Alternatively, you could also work with someone else in the company who enjoys social media and is happy to provide their assistance. This can be a cost-effective solution, but the quality of posts may suffer without the correct skill set.

Hiring an intern is also a possibility. These individuals are usually very familiar with different social media platforms from their own personal usage and can help to bring new ideas to the team. However, there can be continuity issues when moving management from one intern to the next. There may also be compliance concerns with using temporary staff for this type of work.

Tools and platforms to help you succeed

If you’ve been working with social media for several years, you’ve probably noticed the scheduling and monitoring tools change. There are more options on the market than ever before, all to help you schedule posts ahead of time, listen to conversations around your brand, and archive old content for you.

For scheduling, Buffer, Hootsuite, SEMRush, Hubspot, and SharpSpring are some of the most commonly used. Many are now offering listening services within the platform, allowing you insight into what the outside world says about your company. You might even be using a tool like this already since most are quite similar in functionality. Archiving tools are less common but can be helpful for compliance. Archive Social, Denim Social, Social Assurance, Smarsh, PageFreezer, and Global Relay are just a few.

Choosing the right tool for you can be a tough decision when so many are available. Talk to other banks in your area to see what the general feeling is about different software and how they’re using the features (which you’ll want to compare to your own needs). Keep in mind that many platforms will pay to be the “official” platform of a conference or be endorsed by specific organizations. This doesn’t always mean that they’re the best, so demo a few and ask around.

Best practices for social media advertising

Since organic reach on social media is limited, understanding how to leverage digital advertising in this space is the best way to amplify your efforts and see results.

Facebook and Instagram

You may have already used the “lite” page advertising option on Facebook by boosting a post so that more followers see your content or even used the Facebook Business Suite for more advanced targeting.

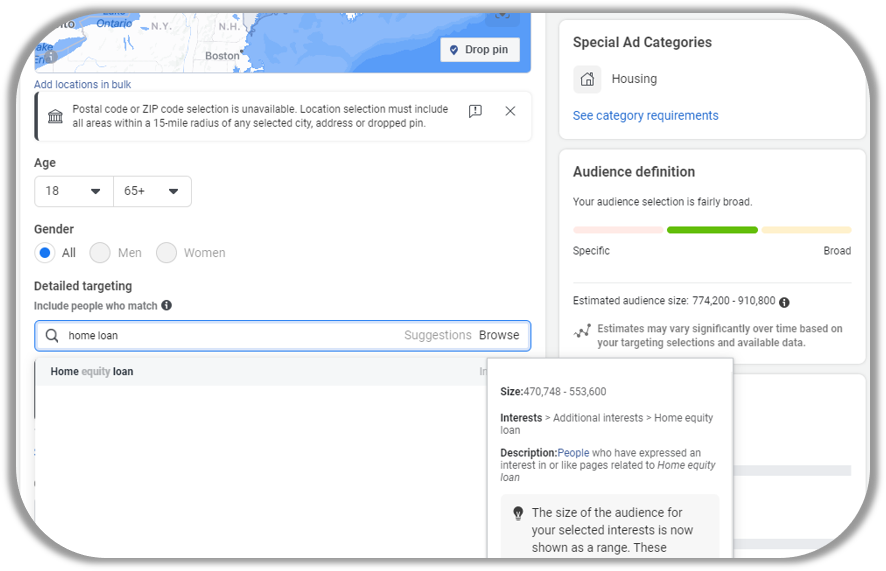

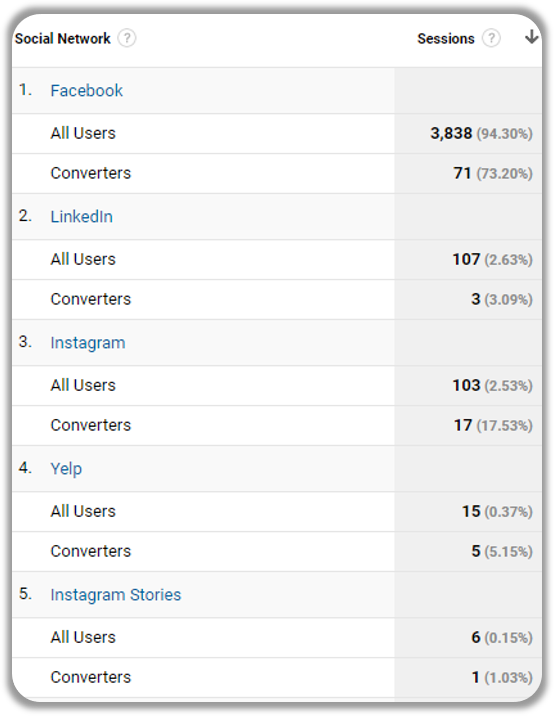

Financial institutions used to benefit from a wide range of demographic targeting options, but thanks to recent updates, this has been severely limited by the Special Ads Category. Geotargeting must be within at least a 15-mile radius and targeting is now general interest only. It’s best to think of Facebook ads as an assisting channel to promote content since the cost-per-click (CPC) is low, but you’re unlikely to see many conversions due to the broad targeting.

Keep in mind that you can upload a list of customer emails to Facebook for ad targeting, which typically has a good match rate and is a cost-effective complement to direct mail, emails, and other cross-promotion that you may be working on.

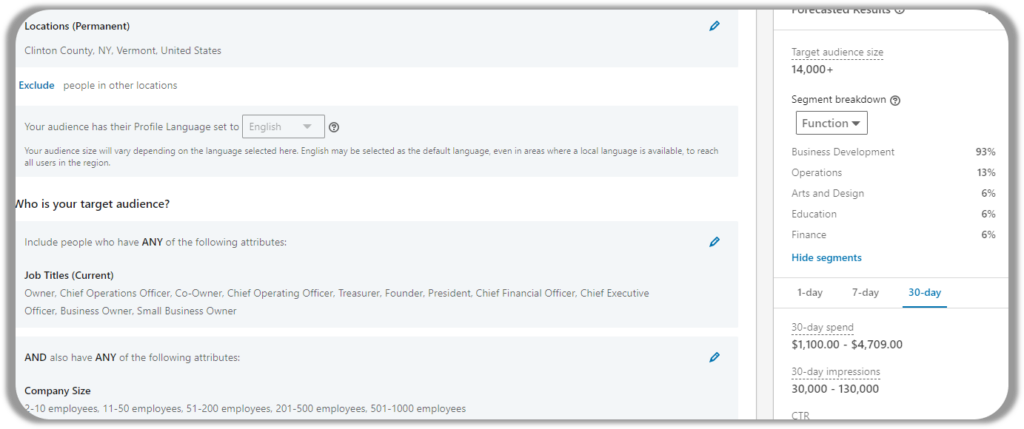

LinkedIn allows for more targeted ads than Facebook, but remember that this should be used primarily for business targeting (or employees if you’re recruiting). The acquisition options include targeting by title, industry, and company size demographics, along with the ability to target by specific company name.

Like Facebook, LinkedIn also offers remarketing and customer matches using email addresses that you upload to the ad system. Overlaying additional targets like seniority, job function, or title can be helpful for both including and excluding particular audiences. All ads can be directed to your website, or you can even capture their contact details from inside LinkedIn itself.

YouTube

The possible reach with YouTube is vast and with so many different ad formats and targeting options, it’s a challenge to know where to start. Keep your first campaigns small and continue to test as you go.

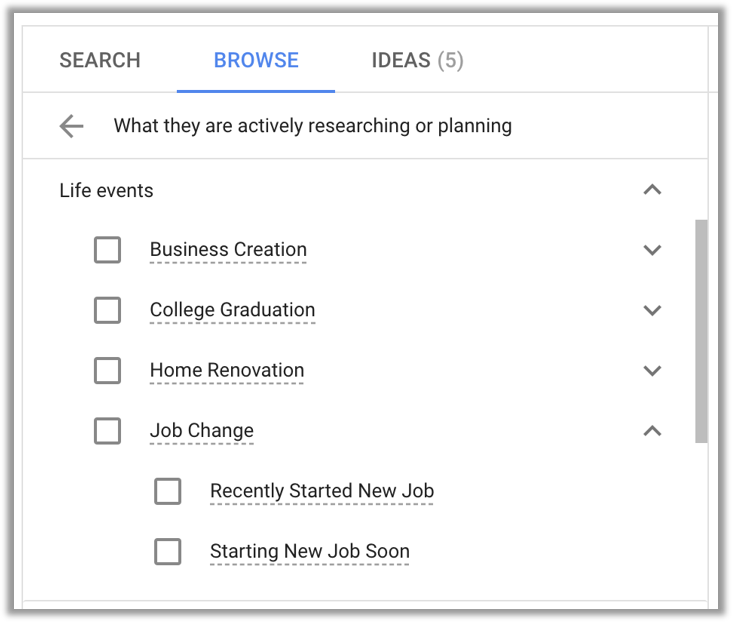

When it comes to targeting, you can advertise to existing customers, people who have recently visited your site, and even individuals that Google identifies as “in market” for a particular product or have a significant life event like college graduation or a new job. You can also target specific videos or channels that your audience might be interested in.

Generally speaking, the ROI on YouTube is good and it’s a great channel to re-engage non-converting website visitors with banner and video ads. But it’s also easy to blow through your budget quickly on completely irrelevant audiences, so having a dedicated team member to manage and optimize these campaigns on an ongoing basis is crucial.

Other campaign types

Both Facebook and LinkedIn allow you to run ads for event promotion, where users can RSVP directly and share their attendance with their connections. Content promotion is also a cheap way to build engagement on both platforms. Data from these engaged users can later be added to a remarketing list to re-target them with product-specific ads. This is one of the best ways to nurture your prospects into leads.

Most platforms also allow you to upload your customer email lists into the software and target your ads this way. These one-to-one ads are usually very cost-effective and a great way to supplement your broader advertising campaigns.

Measure ad performance

How do you know if your ads have been successful? Focus on conversions, either directly through lead forms like LinkedIn’s lead generation or conversions that happen on your website. You should be tracking all ad campaigns with tagged URLs and Google Analytics Goals to ensure that all data is identifiable.

It’s easy to get caught up in the vanity metrics of ads. Some are worth tracking, particularly if increased engagement is a goal. But ultimately, ad impressions and click-through rates mean nothing if your ads aren’t generating any new business for your financial institution.

Social media advertising challenges

Even when you’re putting money towards an ad campaign on social media, these platforms are still focused on dialogue. People can and will comment on your ads, both positively and negatively. Monitor these comments for any “tag along” businesses who try to promote their enterprise on your ad as it’s being shared.

Ad fatigue is also something to think about. Unlike search engines, where users actively look for information, ads target a specific bucket of people. That means that the same individuals could see your ad repeatedly. Engagement may start high but can quickly decline when ads become repetitive. Swap creative out each month to keep your campaign fresh.

It’s also important to keep in mind the targeting restrictions that platforms have in place. While these are done with the best intentions to prevent discriminatory advertising, they leave advertisers with few targeting options, which leads to poor ad performance.

How to stay compliant on social media

One of the biggest concerns that banks have when it comes to social media is staying compliant. While apprehension is understandable, there are ways around this: documentation.

Consider adding social media policies to your employee handbook that outline what is and isn’t acceptable when posting about the brand. Use this as an opportunity to activate employees as brand ambassadors and amplify your content to wider audiences.

There should also be a board-approved social media policy that’s reviewed and updated annually. This must include how your social strategy supports your overall marketing plan, your goals for social that align with the bank’s strategic vision, and KPIs that you’ll use to measure performance.

Include detailed processes about the channels you’ll be using, staff with access to those channels, content creation and approval processes (including responses to comments, reviews, and complaints), and the clear separation of duties among the team. There should also be notes about security protocols and branding requirements for all channels and platforms.

As a complement to your social media policy, document any necessary training procedures so that no single person runs all of your social media alone. There should always be a contingency plan for both the bank and for the well-being of that individual.

Partnerships with social media influencers

Influencer marketing isn’t new, but social media has made it more approachable and accessible for businesses of all sizes. Despite this, financial institutions still face several challenges when incorporating partnerships into their marketing.

As social media influencer marketing has matured, the price of working with individuals has increased. For local banks, it can be difficult to find meaningful influencers within budget who will be impactful on a local level. There’s also a lack of control over who else an influencer is working with and what they post outside of your partner content.

Relevance is one of the biggest hurdles financial institutions face with influencer marketing. Unboxing a debit card doesn’t have anywhere near the same appeal as a new clothing item or high-tech gadget. This can make the impact of influencer marketing difficult to handle since these campaigns also have a short shelf life and don’t always produce actual leads.

This isn’t to say that influencer marketing can’t work for banks. Clearly define your goals before you get started with any campaign, whether that’s brand awareness (like having your logo on a mug in an influencer’s video), driving traffic to your site (through an influencer sharing a helpful resource), or some good old-fashioned product promotion to generate leads.

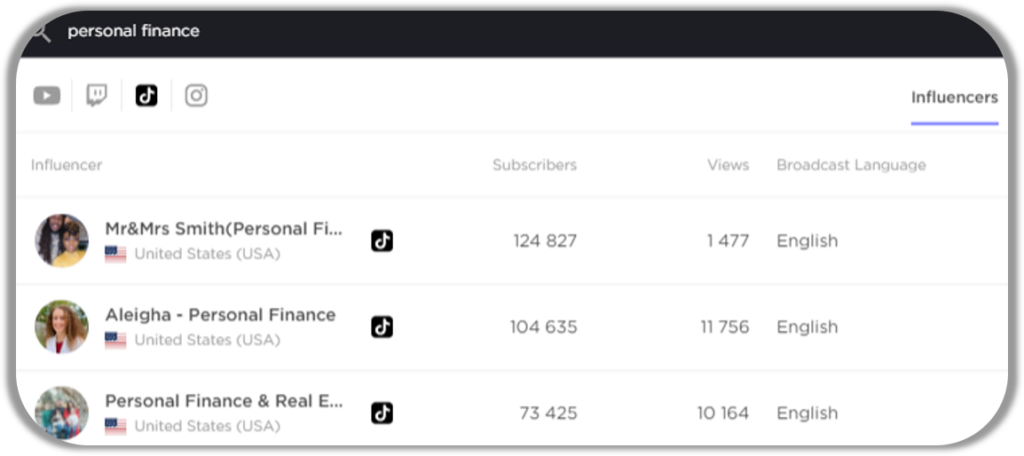

Once you have your goals, you can start looking for influencers. Marketplaces like BuzzGuru, BuzzSumo, and NinjaOutreach all come with a cost but can be useful. You can also search hashtags or do some Googling yourself. When you have a list of names, reach out to see if they’re open to working with you and their rates for different types of engagement.

But before you look for individuals out in the wider world, turn a little closer to home. Lenders and executives within your company tick many of the same boxes that influencers do, so think about how you can leverage their expertise first. They know your market, products, and brand better than any influencer ever could and likely already have a very relevant following of their own to target.

Working with internal influencers first is a good chance to start small. Record an interview or host a live webinar to ask questions or solicit tips and advice. Take clips from the longer video to repurpose on social media, write a blog post around the same topic or create a transcript of the video (great for SEO!) and share this with your customers via email or in social media ads. There are plenty of ways to distribute one piece of content across several digital platforms, and thanks to your association with the internal influencers, engagement is often high and very relevant.

TikTok and the future of social media for banks

When we think of up-and-coming social media platforms in 2024, the hottest right now is still TikTok. If you’re not familiar with the app, TikTok is a video-based platform where brands and individuals can upload short (between 15 and 30 seconds) entertaining clips for their audience.

Most videos posted to TikTok will receive at least some views, usually receiving hundreds or thousands fairly quickly at low cost and low effort. Remember that the demographic skews younger here, so keep your content relevant to this group.

While the high view count is enticing, the value of TikTok views is questionable. The younger audience on TikTok also comes with its own challenges. These users are perceptive and quickly see through brands that aren’t genuine. They have short attention spans and easily navigate around ads, so keeping them engaged with banking (rather than entertainment) content can be a struggle.

As a new platform, the true ROI of TikTok is still unknown, but early data suggests few website referrals and leads, and low engagement for educational content. Similarly, the advertising options are still in their infancy, with little targeting relevancy for financial institutions.

If you’re still interested in giving TikTok a go, look to your internal team for support and create a few fun videos to get you going. There’s no harm in trying out the platform and abandoning it later if you run out of time or don’t see success. As with your other channels, focus on helping or entertaining first, selling second. Re-create content that other successful banks have made and start an educational series that can be shared across your other video platforms like YouTube.

Take your first steps on banking social media

With all of that information in your pocket, you’re ready to start posting. Before diving in, remember to level-set your business goals for the channels you’re planning to work on. Don’t make social media the center of your marketing strategy. Instead, think of it as one spoke in the larger wheel that stems out from your website. Align your expectations and goals before launching any organic or paid social media campaign.

Be prepared for ongoing experimentation as no digital marketing channels are “set it and forget it.” Keep your branding consistent as your social channels evolve and always focus on creating value for your audience. With this in mind, you’re setting yourself up for ongoing success on your social media platforms.

Learn more about leveling up your bank’s social media with resources and guidance from BankBound. Take a look at our blog for helpful tips on other digital marketing best practices, or speak to one of our team today about our social media management services for financial institutions.